Sustainable Investing: Can you do well by doing good?

With sustainable investing, investors week to do well by doing good. Closer examination, however, reveals a developing niche that should be approached with as much caution as enthusiasm.

Seek patience and passion in equal amounts. Patience alone will not build the temple. Passion alone will destroy its walls.

(Maya Angelou)

I get a lot of inquiries from (female) prospects and clients around sustainable investing (ESG and SRI). The strongest level of interest seems to be among Millennials and Boomers. The former wants to inherit a livable planet while the latter wants to leave a livable planet.

Given the increased media coverage, public interest, option in and adoption of sustainable investments, I thought I owe it to myself and my clients to revisit and reevaluate this space more thoroughly to determine how best to guide those earnestly seeking to align their money with their values.

Sustainable Investing – Evolution[1]

As often the case, history provides important context for the emergence (or resurgence) of events and phenomenon, including sustainable investing. The concept took root among religious groups and can be traced as far back as Biblical time. For Jews, the first five books (Pentateuch) of the Bible contained rules that governed all aspects of life, including the economy. For Muslims, the Qu’ran established guidelines (Shariah laws) that sought to prevent exploitation. Additionally, it ruled out investments in alcohol, pork, gambling, armaments, etc. In eighteenth-century America, the Methodists and then the Quakers shunned the slave trade, investments in tobacco products and gambling.

Within the twentieth century, external events gave rise to greater public interest and activism in political and capital arenas. For example, in the 70s, escalation of the Vietnam War and use of chemicals helped spur the development of the first sustainable mutual fund. In the 80s, apartheid and the Exxon Valdez spill in Alaska further increased international interest in sustainable investing. In the 90s, greater awareness of global warming led to the Kyoto Protocol, which was an agreement among nations on efforts to curb carbon emission.

The twenty-first century ushered in a more global effort to standardize, inform and guide public discussions and strategies for addressing global warming. In the 2000s, the United Nation launched the Principles for Responsible Investments, which sought to integrate environmental, social and corporate governance into capital markets. This further solidified efforts to align investments with values and set us on the course we find ourselves today.

Sustainable Investing – Increasing Trend[2]

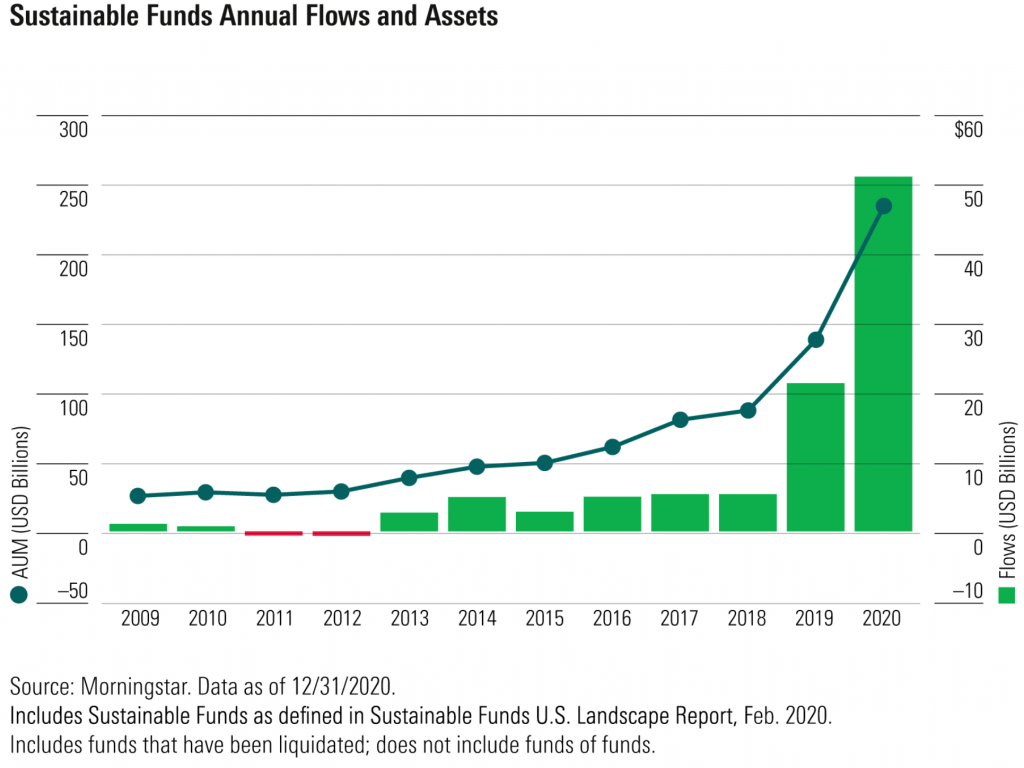

In recent years, the momentum for sustainable investing has accelerated exponentially. In 2019, net inflow into sustainable funds quadrupled that of 2018. Covid further quicken the adoption rate. During the first quarter of 2020, net outflow from mutual funds was approximately $384.7 billion, while net inflow into sustainable funds was around $45.6 billion. Within the US alone, sustainable funds attracted a record $51.1 billion in net inflows, more than twice the 2019 record and nearly one fourth of overall inflow into funds in the U.S for 2020.

Sustainable Investing – Things to Consider

Given the growing frequency and severity in global natural disasters, it’s heartening to see investors increasingly putting their money where their mouth is. However, when ideal meets reality (or morality meets money), the result is often more gray as is the case with sustainable investing. First, currently, there’s no standard benchmark for sustainable investments. While some fund managers target companies that meet the UN Sustainable Development Goals, others leverage different screening techniques. Some use a negative screen, which excludes companies seen as engaging in poor ESG behaviors: alcohol, tobacco, gambling, nuclear power, animal testing. Meanwhile, others use a positive screen, which includes companies seen as engaging in good ESG behavior: energy conservation, natural resource conservation, carbon neutrality. Moreover, some fund managers use a combination of both screening techniques.

Second, those who seem to suggest that investors can do well by doing good point to the performance of sustainable funds, especially in recent year(s). Generally speaking, many sustainable funds tilt towards tech and healthcare and away from financial and basic materials as the formers typically emit little, or no, carbon.[3] However, there are two issues with sustainable “tilts.” One, while tech has a good score when measured against ESG criteria, it has a lower score when measured against SRI criteria. Consider Facebook’s alleged (mis)use of user data or Amazon’s treatment of warehouse workers. Two, there are two prevailing investment styles in capital markets: growth and value. Growth seeks to invest in companies whose earnings are projected/expected to be above average (think tech). Meanwhile, value seeks to invest in companies which are selling less than intrinsic worth (think banking). History has shown that due to reversion towards the mean, growth will lead for a period, but value the next. Interestingly, as growth continues to trounce value over the past decade, it’s expediting the reversion towards the mean. Doing well by doing good? Capital market forces may yet prove otherwise.

Third, as public appetite for sustainable investments grows, companies have increasingly sought to fulfill such demand, which has given rise to “greenwashing.” This is when companies and funds give misleading claims regarding their products, services and sustainable credentials.[4] However, upon closer examination, such products, services and investments may not be as green as consumers have been led to believe. (Caveat emptor!)

Sustainable Investing – Ways to Integrate into Your Portfolio

Sustainable investing is still in the developmental phase. Additionally, its moral mandate seems at odds with market forces. How to integrate sustainable investing into one’s portfolio? In my opinion, for now, the best way to view and integrate sustainable investments as a tilt (or smart beta for the three finance geeks out there). This strategy involves establishing the bulk of ones portfolio in broad-market domestic and international index funds with a solid long-term performance record (10 yrs or more) and then allocating 5-10 percent of your portfolio (tilt) to sustainable investments. Should sustainable investments’ performance exceed those of broad-market index funds, great! If not, it won’t upend your financial plans and goals. (Heads you win, tails you only lose so much!)

Conclusion

When it comes to sustainable investing, can you do well by doing good? Since the sector is still evolving, it lacks clear benchmarks, standardized practices, a long-term performance record and is prone to greenwashing. As is, the jury is still out on a definitive answer. (Perhaps the jury will always be out…who knows.) As companies and investors sift through this evolving landscape, perhaps it’s more realistic and financially savvier to revise the question: Can you do well and do good? By decoupling these two goals, we retain greater personal responsibility/control for securing our own financial well-being and (re)gain more options/discretion on how to better ourselves, our families, our communities, our planet.

Resource: Bill Gates What you can do to fight climate change.

[1] “ESG Investing Comes of Age,” Morningstar, March 2021

[2] “ESG Investing Comes of Age,” Morningstar, March 2021

[3] “Does Sustainable Investing Constrain a Portfolio,” Alliance Bernstein, August 2019

[4] “What Is Greenwashing? Here Is What Investors Need to Know,” WSJ, November 2020

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.