Power of Patience: Make the most of your 401k

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

Every game is won with patience.

(Mellody Hobson)

It’s that time of the year again…Thanksgiving and open enrollment for those fortunate enough to work for employers who offer employee benefits, especially a retirement plan. According to the US Bureau of Labor Statistics, 67% of workers have an employer-sponsored plan (usually a 401k).[1] To kill two birds with one stone (sorry!), I thought I’d take this opportunity to reflect on the seemingly humble 401k, which recently celebrated its 45th birthday. (Happy Birthday, baby!)

While the 401k has become ubiquitous, based on my experience, it’s still not well understood and, thus, not fully taken advantage of by the majority of employees. For example, when reviewing 401k statements, it’s not uncommon for me to see that most workers’ contributions are defaults: auto-enroll; auto contribute 3% of salary; auto invest in target date funds (typically, if they’re lucky).

Also, most people are gobsmacked when I share with them the guaranteed return (and dollar amount equivalent) they are passing up by not maxing out their 401k. (CLARIFICATION: I’m speaking specifically to those for whom it is financially feasible to max out their 401k, but are not doing so.) Upon hearing this, most people express awe…then regret…then excitement as if they’d just discovered that they’ve been sitting a chest full of gold all along. (And, they are!)

Here are 3 KEY WAYS you can make more money by maxing out your 401k (or equivalent retirement plans: 403b, 457).

Income Tax Savings

Rather than going with the default annual contribution of 3% of your salary, consider maxing it out. For example, let’s say that you earn $100,000/yr (gross income). Instead of contributing 3% of gross income/yr ($3,000/yr), consider maxing out your 401k by contributing 23% (or $23,000/yr – 2024 contribution limit for those under age 50; $30,500 for those age 50 and over). By maxing out your 401k, you increase your annual income tax savings from $600 (3% contribution) to $5,000/yr (23% contribution)… a difference of $4,400/yr more! Additionally, by increasing your annual 401k contribution, you also increase your annualized (guaranteed) return from 2.6% ($600 / $23,000) to 22% ($5,000 / $23,000).

Interestingly (or sadly), the more your make, the more you’re able to earn (or save) by maxing out your 401k. So, if you earn $150,000/yr, then your income tax savings is $5,500/yr (24% annualized return). If you earn $200,000/yr, then your income tax savings is $7,000/yr (30% annualized return).

GUARANTEED ANNUALIZED RETURN: 22% – 30% (depending on your gross income)

Employer Match (50% up to 6% of salary)

This is the most common 401k employer matching formula: 50% up to 6% of gross salary.[2] How does this translate in real life? Again, let’s assume you earn $100,000/yr. If you contribute the default 3% ($3,000/yr), then your employer match is 1.5% ($1,500). But, if you max out your 401k by contributing 23% ($23,000/yr), then your employer match will be 3% ($3,000/yr) – $1,500/yr more. The higher your employer matching contribution, the higher your annualized return. At the default 3% ($3,000/yr) contribution, your employer match ($1,500/yr) translates to 6.5% annualized return ($1,500 / $23,000). At the maximum 23% ($23,000/yr) contribution, your employer match ($3,000/yr) = 13% annualized return.

As with income tax savings, the more you earn, the higher your return via employer match. So, if you earn $150,000/yr and max out your 401k ($23,000/yr), then your employer match is $4,500/yr = a 20% annualize return. If you earn $200,00/yr and max out your 401k ($23,000/yr), then your employer match is $6,000/yr = 26% annualized return.

By maxing out your 401k, you increase your employer match and, therefore, take full advantage of yet another lever that delivers an incredibly high guaranteed return.

GUARANTEED ANNUALIZED RETURN: 6.5% – 26% (depending on your employer match, contribution amount and gross income)

Investment Options (potential for higher returns)

To help employees save and invest more appropriately for their retirement, more and more employer plans are offering target date funds (TFD). A target date fund is a mutual fund that’s composed of other mutual funds (typically): US stock blend; international stock blend; US bonds; international bonds. TFD 2025 assumes you will retire in 2025 and so are less concentrated in stocks (appreciation) and more in bonds (preservation). Meanwhile, TFD 2055 assumes that you will retire in 2055 and so are more concentrated in stocks (appreciation) and less in bonds (preservation). So, if you’re 60-years-old and are looking to retirement in 5 years, then TFD 2025 is likely more appropriate. However, if you’re 30-years-old and are looking to retire in 35 years, then TFD 2055 may be more appropriate as the higher stock concentration will help power the growth of your nest egg for retirement.

As you draw closer to your target retirement year, your target date fund will automatically rebalance from stocks to bonds. Most target date funds level out at 50% stocks and 50% bonds once it reaches the set retirement year. In terms of simplicity and efficiency, target date funds are typically one of the best investment options for most employees. (Set it and forget it!)

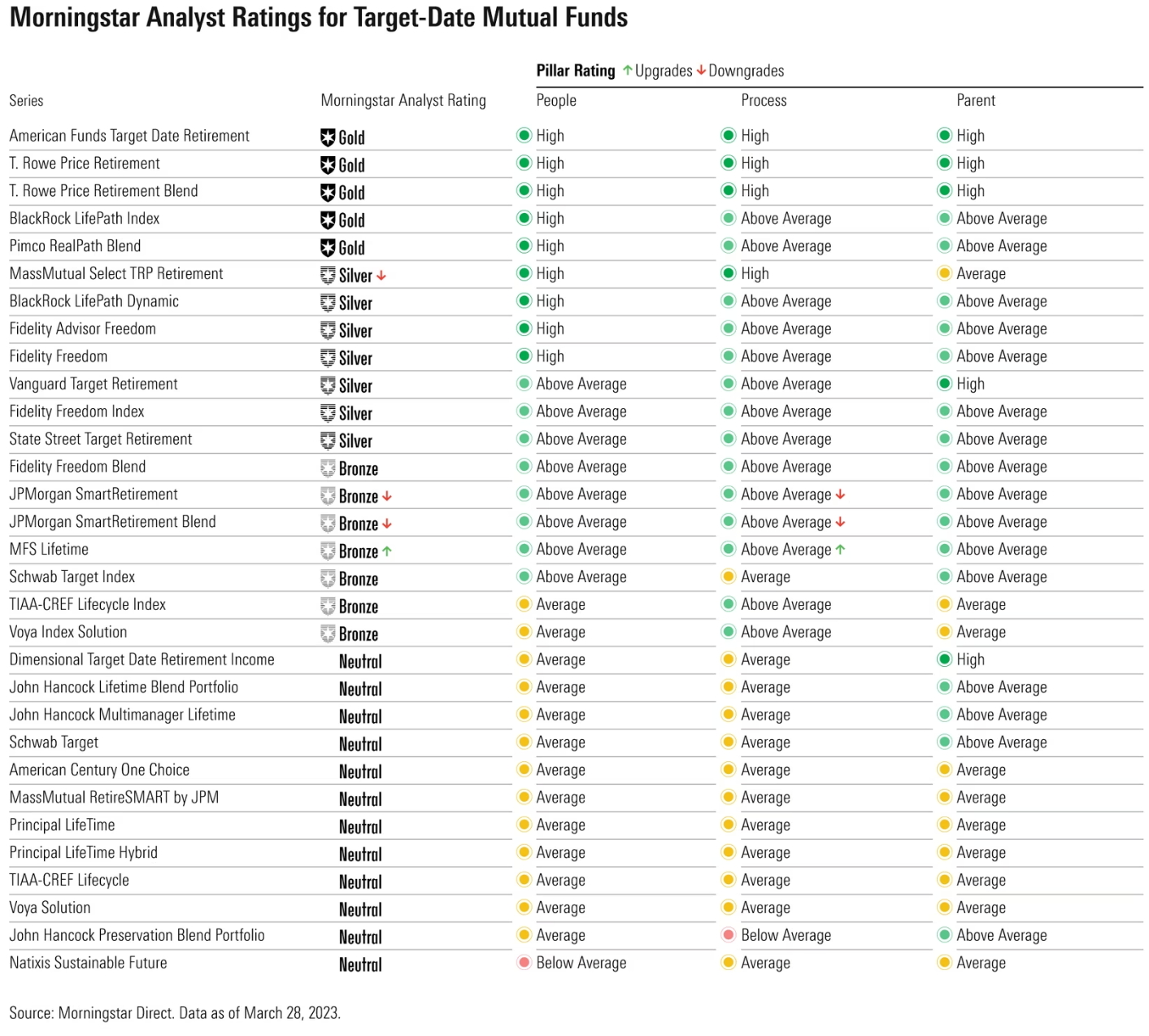

For those who are fortunate enough to have target date funds as part of your 401k investment options, below is Morningstar’s latest ranking of top TFD medalists, which can be a handy cheat sheet.

In my opinion, not all target date funds are created equal. The key variables I look at when evaluating such funds are: reputation and financial strength of fund parent; fund track record (10 years or longer); fund expense ratio (less than 0.5%); fund asset allocation (US vs international = 60/40). Based on those criteria, among Morningstar’s top medalists for target date funds, here are my favorite: Vanguard Target Retirement, Fidelity Freedom® and BlackRock Lifepath Index.

POTENTIAL ANNUALIZED RETURN: 5% – 10% (depending on your asset allocation and quality of investment options)

Final thoughts…

Reversing 2022 decline, this year’s stock market has rallied hard. Predictably, FOMO (fear of missing out) is back in the headlines. Still, based on my experience, the biggest returns investors are missing out on is not by making the most of the market, but rather their 401k. While the potential average annualized return for investing in a moderate growth portfolio (75% stocks and 25% bonds) is 7% – 10%, the guaranteed average annualized return from maxing out your 401k is 28% – 56%, depending on your gross income and employer match. The higher your contribution, the higher your income, the higher your employer match, the greater your guaranteed average annualized return. (Talk about compounding!) So, before you look to the stock market to power you towards a comfortable retirement, consider looking more closely at your 401k, especially at this time of year. You’ll likely discover that you’ve been sitting on a chest full of gold and not realize it.

Now that’s something to be thankful for!

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2023 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.