Paradigm shift: 2022 Market Recap and 2023 Market Outlook

2022 volatile markets reflected a paradigm shift from a low interest/low inflation world to a higher interest/higher inflation world. Investment outperformers declined while laggards rallied; borrowers were penalized and lenders benefited. How to position yourself for 2023?

Successful investing doesn’t come from buying good things, but from buying things well. (Howard Marks)

Executive Summary

2022 Recap

· Volatile financial markets marked a paradigm shift in Fed policy and, thus, financial markets as a whole.

· Low inflation (2%-3%) and low interest rates (3-4%) that defined and propelled growth and high stock market returns of the past 40-years reversed quickly and dramatically to higher inflation (5.7% – December 2022) and higher interest rates (6.4% – December 2022) in the current and foreseeable future. (Source: US Bureau of Labor Statistics)

· Beneficiary: Savers and lenders now earn a higher interest (3%+) on their cash and bonds (especially short-term).

· Penalized: Borrowers now pay higher interest (6%+) for the privilege of using someone else’s money.

2023 Market “Outlook” (Consensus or Guesses)

· Fed will continue to raise interest rates although less aggressively (0.25% or 0.5% vs 0.75% – quarterly in 2022) as it continues to fight inflation.

· Inflation and, therefore, interest rate will stay high-ish (4-5%) in the foreseeable future.

· Corporations and individuals will continue to feel the pressure of high(er) interest rate, resulting in lower investments in property, plant, equipment, people, etc.

· Continued layoffs will slow income growth and, thus, reduce inflation.

· Result: Mild to moderate recession.

My recommendations to investors

· Understand markets on the macro level, but manage and invest your money on the micro level as it relates to your situation; your need for return; your appetite for risk; your investment horizon; your goals.

· Take steps (now) to limit your potential downside.

· Take steps (incrementally) to increase your potential upside.

2022 – Market Recap (I’ll try to keep this short as most of you have seen this scary movie.)

Turbulence! Breaking the prevailing historical pattern (and assumption) that bonds zig when stocks zag, both assets declined relentlessly and in tandem in the face of the Fed’s aggressive raising rates. No doubt you felt the pain every time you (dared) to peek at your investment portfolio. Perhaps you’d be comforted (or not) to know that my own portfolio’s return also ended the year in double-digit red. I eat my own cooking, so I adopt many of the investment products/strategies that I recommend to others. Since I started investing in 1998, I’ve seen different versions of this movie before: Dotcom bust (2000-2002); Great Recession (2007-2009); Covid pandemic (2020). To ease the impact of short-term decline, such as the one in 2022, I strongly advocate a long investment horizon (10+ years). Still, I think it’s important to be aware of the big (market) picture as it:

· Provides a useful framework for understanding the positioning of our portfolios.

· Gives us a better sense of current opportunities and risks and how to address them.

· Enables us to make more informed (financial) decisions.

2022 – The Numbers…

Below are the 1-, 5- and 10-year return for key indices, ending December 31, 2022. There were few asset classes in which to hide with the exception of cash and short-term treasuries, which increased noticeably in response to Fed’s aggressive raising of rates. But, with inflation still running hot by year end (6.7%, ending 12/31/22), it was difficult to cheer too loudly or long as cash and treasuries netted negative returns.

|

Key |

2022 |

5 year |

10 year |

|

MSCI |

-19.2% |

8.8% |

12.1% |

|

S&P |

-18.1% |

9.4% |

12.6% |

|

Spliced |

-24.1% |

9.1% |

12.6% |

|

MSCI |

-16.0% |

88.0% |

13.1% |

|

Bond |

-16.4% |

5.8% |

8.0% |

|

Spl |

-3.8% |

0.7% |

0.7% |

|

US |

1.3% |

0.9% |

0.5% |

Source: Vanguard Benchmark returns, ending 12/31/23.

More relevant to you (investors) is the performance of popular (or “typical”) portfolio mix composed of stocks and bonds. Mimicking negative returns of major indices (above), such portfolios also suffered double-digit losses. The conservative and popular 60/40 portfolio favored by most retirees didn’t fare better than more aggressive siblings due to bonds’ sharp (short-term) decline.

|

Key |

2022 |

5 year |

10 year |

|

Target |

-15.0% |

4.0% |

6.8% |

|

Target |

–16.2% |

4.7% |

7.9% |

|

Target |

–16.5% |

5.1% |

8.4% |

|

Target |

–17.1% |

5.6% |

8.7% |

Source: Vanguard Benchmark returns, ending 12/31/23.

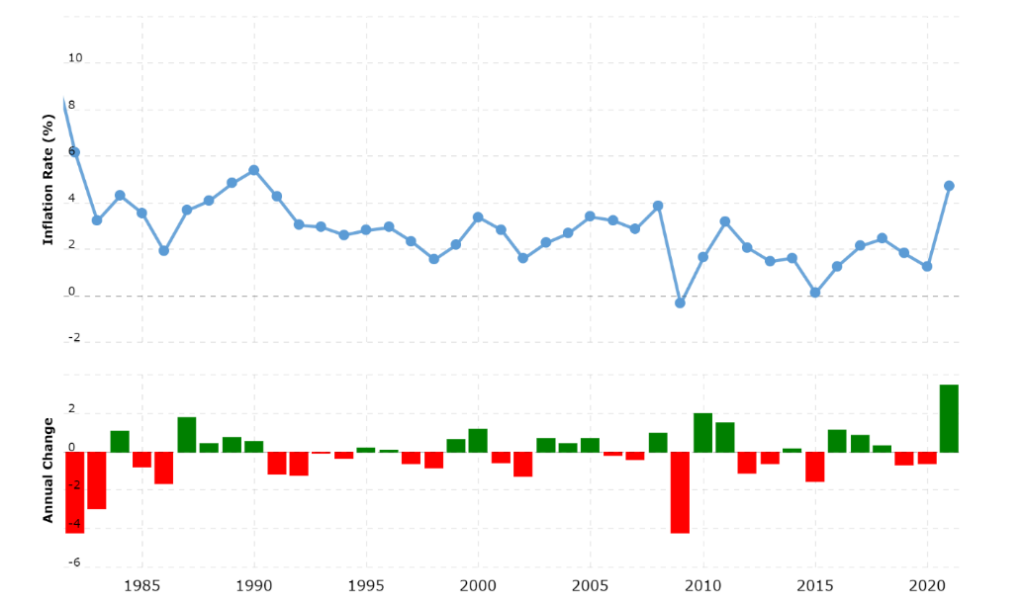

2022 – Long story short-ish

In 1979, when Paul Volcker became Fed Chairman, he raised interest rates aggressively to combat persistently high inflation of the 70s and early 80s (20% in 1981). Result: Back-to-back recessions. But by 1983, Volcker had successfully brought inflation down to 3%-4%. (See graph below – Exhibit 1). For the next 40 years, annualized interest rates remained historically low (2-3%). Cheap money accelerated individual and corporate wealth-building efforts by making it easier, cheaper and more lucrative to borrow and invest.

Exhibit 1: US Inflation Past 40 Years

Source: Macrotrends LLC, 2023

In early 2020, COVID came into the picture. Pandemic, coupled with war in Ukraine and a tight labor market (think boomers retiring), triggered a chain of events that quickly flipped the 40-year-old paradigm from low inflation/low interest to higher inflation/higher interest. To mitigate a potential depression brought on by COVID, the US government’s stimulus checks, Fed’s cutting of rates to negative and tight labor market dramatically increased the money supply. Meanwhile, supply chain issues due to COVID and exacerbated by the war in Ukraine further reduced goods and services. Result: Inflation = more money chasing fewer goods. (Inflation increased from 1.4% in January 2021 to 5.7% in December 2022.)

Beginning March 2022, the Fed raised rates aggressively by 0.5% increment and then 0.75% increments (quaterly) to avoid 70s-style high inflation, recession and stagnation. Increased rates stopped the party quickly and abruptly. Individuals and corporations who’d relied on cheap money to power investments, growth and wealth now had to pay a lot more. (Think 30-year fixed mortgage rate doubling from 3% in January 2022 to ~6% by June 2022).

This policy reversal, in turn, triggered stock market volatility and decline. Sectors (e.g., tech, crypto, housing) that had benefited most from low interest and the pandemic have, in turn, experienced the greatest uncertainty and steepest decline due to this paradigm shift. Inversely, savers (via high-yield savings account) and lenders (via fixed income – bonds) increasingly enjoyed higher returns for much lower risks. By end of 2022, TINA (There Is No Alternative) had become TARA (There Are Reasonable Alternatives).

2023 – Market “Outlook” (Consensus or Guesses)

Here (again) is the prevailing market outlook for 2023.

· Fed will continue to raise interest rates although less aggressively (0.25% or 0.5% vs 0.75% – quarterly in 2022) as it continues to fight inflation.

· Inflation and, therefore, interest rate will stay high-ish (4-5%) in the foreseeable future.

· Corporations and individuals will continue to feel the pressure of high(er) interest rate, resulting in lower investments in property, plant, equipment, people, etc.

· Continued layoffs will slow income growth and, thus, reduce inflation.

· Result: Mild to moderate recession.

My recommendations to investors

Although market outlooks are interesting and make for great headlines, they are rarely correct (think never). Also, ironically, if the market outlook (above) is consensus, then you will unlikely make money from leveraging it. The more people become aware of the prevailing forecasts, the lesser the opportunity for gains.

When it comes to investing, the money is often made by going against consensus, rather than following it. (Contrarianism) Reason being, it’s hard and painful to do as it requires buying (low…cheap) investments that are often overlooked, if not forgotten or hated, because they are deemed unsexy, too risky, too uncertain…dead. Additionally, it requires tremendous conviction, courage and resolve to hold onto such investments from low to high.

2023 – Take steps (now) to limit your potential downside

· Have an emergency fund of at least 10-12 months’ worth of living expenses, at least. But, if you have dependents, lots of debt (e.g., mortgage), live on one income and/or fear market volatilities, then consider increasing your emergency fund to 12-16 months’ worth of living expenses. Rationale: A larger cash cushion doesn’t just allow you to address life’s emergencies (e.g., home repair, layoffs), but also enables you to stay invested (aka buy and hold).

· Those in early or mid-career and looking to buy a home, consider sitting on the sideline for another 1-2 years. Rationale: Give yourself more time to save up for a healthy down payment (20% or more). Also, should the Fed continue to raise interest rates, housing prices will likely continue to decline due to fewer available buyers. To mitigate the impact of high(er) interest rates, consider saving enough not just for a 20% down payment, but also so you can put extra cash (monthly) towards the principal of your mortgage. Doing so (prepayment) will help you artificially lower your mortgage rate by as much as one percentage points.

· If nearing or in retirement, buildup 4-6 yrs’ worth of living expenses at least. Potential places to put your cash cushion: a) High-yield online savings account (Ally Bank – 3.3% interest) b) CD ladder (Ally Bank 9-month CD = 3.5% interest; 12-month CD = 4.25%) c) Short-term treasury funds (Vanguard Short-Term Treasury Fund Investor Shares (VFISX) = 4.15%. Rationale: This will help ensure that you won’t be forced to sell in a market downturn > lock in your losses > reduce the size of your portfolio and, therefore, lower your income withdrawals throughout retirement.

· Pay off high-interest debts (5% or higher). Debt is an obligation, which you must continually service, regardless of whether or not you have a job. Rationale: The less debt you carry, the less beholden you are to others (think employer, banks, stock market) and the more likely you are able to ride out market downturns.

· Hold off on making big purchases (e.g., homes, cars), especially if they require higher interest loans, to help preserve cash and keep your options open. Rationale: Get paid (via higher interest) for waiting. If the economy continues to weaken, you could make bigger purchases ON SALE.

2023 – Take steps (incrementally) to increase your potential upside

· If you’re still working, earning and saving (or accumulation phase), max out your retirement accounts (e.g., 401k, 403b, Traditional IRA, Roth IRA) via dollar-cost-averaging. Rationale: Retirement accounts are tax-advantaged and often come with employer matching (4% – average). For each dollar invested in a 401k, the guaranteed return (tax savings + employer match) is around 30% (average) (think free money).

· Rebalance investment portfolios annually > Buy low, sell high.

o Hold a diversified, balanced portfolio…always. Rationale: Potentially increase your return while decreasing your risk. Also, take emotions and the potential inclination to time the market out of your investments.

o Potential opportunities to sell high, buy low:

− US equities (price per earnings (PE) = 18) remain relatively expensive, while international equities remain cheap. (NOTE: Historical Average PE = 16) Potential opportunity within US equity: Value segment (PE = 15) will likely continue to revert towards the means as it’s been down for more than a decade.

− International stocks (PE = 11) remain more attractive vs US. It’s cheaper (vs US) and pays a healthy dividend (4%+), which helps

offset some of the risks associated with investing abroad and holding a “down” asset.

− Emerging markets (PE = 10) seem to offer the greatest opportunities as it’s very cheap. However, it’s likely appropriate for the 2 people who’ve read this far and have the strongest of stomachs.

· Keep holding onto bonds, especially short-term treasuries. Rationale: Bonds took a beating in 2022. Given the recent sell-off, bonds are cheaper now. Additionally, as investors continue to look for safety, bonds appear to have better risk-return profile vs stocks.

· Dollar cost average your investments vs going all in. Rationale: When investing, especially in volatile markets, it’s best to take as much of one’s emotion out of the process as possible. Also, dollar-cost averaging allows you to buy some shares low, some high and most in-between.

· Slow and steady wins the race…always.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.