My advice to late-career or early retirement women (mid-50s to early 60s)

Transitioning into retirement is not about becoming less of who you are, but rather more of who you were always meant to be.

She knew this transition was not about becoming someone better, but about finally allowing herself to become who she’d always been.

(Anonymous)

Where did the time go?!?!? It didn’t seem long ago when you’d just graduated from college/grad school, gotten married, had kids, decided not to have kids, gotten divorced (possibly), climb the career ladder…running, running, running. Poof! 30-years have passed. Now, you find yourself surrounded by mostly younger colleagues; feeling less of a “high” from once big career “wins”; becoming more attuned to the micro-aggressions and low-grade toxicity that’s common in most workplaces; checking your retirement accounts more frequently; considering embracing your quickly graying hair; wondering if retirement is really within reach…financially, at least. Retirement! This once seemingly distant milestone now looks paradoxically too close for comfort and, simultaneously, not close enough. Still, as with most big life transitions, preparation is the key to success. (Sorry for the cliché.) If you find yourself shifting from contemplation to execution, here are some key financial considerations to keep in mind as you begin to take steps…

Line up your (financial) ducks…

Let’s assume that you’re a 55-year-old professional woman earning $175K/yr (total compensation). You still don’t know when you’d want to retire, but you do want to know that it’s a viable option. While there are a host of variables (e.g., job security, stock market return) outside of your control, there are some key variables well within your control.

Retirement Viability – Gut check: Wondering if you’re on track to retire sooner vs later? Here are a few quick ways to get a much-needed gut check:

· Net worth: Take your net worth (assets – liabilities) and divide it by your annual living expenses. If the answer is 25xs or more, then you’re likely on track to retire. If it’s less than 25xs, then you need to catch up.

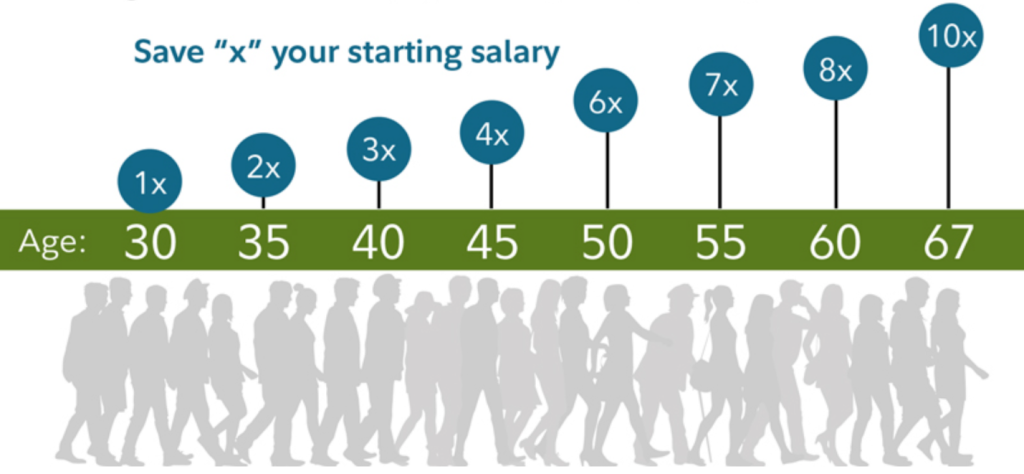

· Retirement savings: In 2021, Fidelity released a study (below) that showed approximately how much retirement savings you should have at certain age. So, if you’re age 55 and earn $175K/yr (total), then your target retirement savings should be $1.22M. (Here’s the math: 7 x $175K = $1.22M).

Emergency Fund: Put away about 12-24 months’ worth of living expenses in a high-yield, FDIC-insured, online savings account: Ally Bank (0.60%), Capital One 360 (0.60%) and Alliant Credit Union (0.60%). To eke out slightly more interest, consider allocating some of that cash to building a CD ladder: 9-months; 12- months. Key benefits: Have cash readily available to address emergencies. Eliminate/minimize the need to borrow at higher interest rate (e.g., credit cards). Key drawbacks: Currently, cash is an unproductive asset as it yields a negative return (0.6%) when factoring high inflation (5-7%).

Short-term bonds (2–3-year maturity): In your tax-deferred retirement accounts (e.g., 401k, 403b, Rollover IRA), start building up 2-3 years’ worth of annual living expenses in short-term bond index funds/ETFs: Vanguard Ultra-Short-Term Bond Investor (VUBFX), USAA Short-Term Bond (USSBX), iShares 0-5 Year TIPS Bond ETF (STIP). Key benefits: This cash-like cushion helps you mitigate sequence of return risk, which is forced selling a part of your portfolio in a downturn in late-career or early retirement to meet living expenses and, thereby, permanently impairing your portfolio so that there’s less assets to compound to meet future income needs. Short-term bond funds are less sensitive/vulnerable to interest rates and offer slightly higher yield (1-2% typically) than savings account and money market funds. Key drawbacks: With interest rates slated to rise and inflation running hot (6-8%) right now, short-term bond funds offer a net negative return.

(Back-door) Roth IRA: Max out your Roth IRA annually via an individual account as well. Income too high to qualify for a Roth IRA? Then, do a back-door Roth IRA. Take advantage of Roth IRA catch-up contribution ($1K/yr – age 50 and older). Key benefits: Assets in a tax-free account (Roth IRA) allows greater flexibility in tax management/minimization in retirement. Also, such assets can compound for decades after age 73 as there’s no RMD. Withdrawals are tax-free. Key drawbacks: You can’t withdraw funds until after age 59 ½. Annual contribution limit ($7K) is low relative to traditional 401k ($27,000).

Brokerage Account: Complement tax-advantaged retirement accounts (e.g., 401k, 403b, Roth IRA) with a brokerage account. Key benefits: A brokerage account offers greater flexibility in terms of where, when and how funds are used. Unlike retirement accounts, you don’t have to wait until age 59 ½ to access assets. Also, capital gains tax (0-20%) is far lower than ordinary income tax (0-37%). Additionally, if you have no annual earned income, capital gains tax on brokerage account withdrawals are 0%. (Yup, you read that right!) Key drawbacks: Since a brokerage account is a taxable account, dividends, interests and asset sells are taxable on an annual basis.

Estate Planning: Make sure that your will, financial and healthcare power of attorney (POA) and account beneficiaries are up-to-date and that your power of attorney and executor know where to locate/access all these legal documents. Key benefits: Legal documents help ensure that your wishes are carried out should you become incapacitated and can’t speak for yourself. Save your heirs the headache and hassle of a forced “treasure hunt” for papers and assets. Key drawbacks: No one likes to think about their own death. Choosing the right individual(s) to designate as power of attorney and/or executor takes some thinking and doing.

Long-term care (LTC) Insurance: Do you have a family history, especially on your mother’s side, of long-term, degenerative illnesses (e.g., Alzheimer’s, Parkinson, stroke, cancer)? Did you mother or maternal grandmother relied on in-home or nursing home care during the remaining 2-4 years of their lives? If so, a good time to consider long-term care insurance is between mid-50s to early 60s. Reason being, LTC insurance is expensive, but becoming more necessary as more American women live longer. Properly timing the purchase of LTC insurance can help ensure that you’ll be able to afford it throughout retirement and will have it when you need it: late-retirement. Key benefits: Provide critical healthcare services not covered by Medicare. Give greater peace-of-mind to family members, who may be left exhausted or bankrupt by your LTC costs/needs. Key drawbacks: LTC insurance is complicated, both in terms of the policy and for whom it’s a good fit. So, be prepared to do some thinking and research. LTC insurance is expensive. Also, important inflation rider comes at extra cost.

Social Security: There are many misperceptions around when to start Social Security benefits. Most women assume that it pays (more) to receive benefits sooner (age 62) vs later (age 70). Unfortunately, the right answer is more nuanced and typically counter-intuitive. Generally speaking, here’s the rule of thumb around benefits:

· If your life expectancy is ≤ age 80, then start Social Security benefit at age 62.

· If your life expectancy is ≤ age 83, then start Social Security benefit at age FRA (full retirement age).

· If your life expectancy is > age 83, then start Social Security benefit at age 70.

Also, from age 62 to FRA, for each year you defer benefits, you receive a 5-6% annualized return. From FRA to age 70, each year of deferment yields a 7-8% annualized return. Since the average American woman’s life expectancy is 82.6 years, delaying benefits until age 70 is likely the best deal. Key benefits: Stock market returns are subject to probability while Social Security “return” via deferment is guaranteed. Lock in a higher “annuity” payment for life. Key drawbacks: Benefits are dependent upon your or your (ex)spouse’s work history. Cost of living adjustment (COLA) tilts towards the conservative. Social Security is typically not enough to cover all living expenses.

Final thoughts…

It’s said that our ending determines our beginning and our beginning determines our ending. As is, when considering sunsetting your career, it may be helpful to have a clear(er) vision for this next stage of your life. Only with that in mind, can you properly plan. Regardless, transitions are usually scary as there are so many unknowns. Still, rather than fear the space unfolding, view it as an opportunity to fill it with people and things that support and reflect the person you really are rather than the different roles you felt you had to play for much of your life.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.