Make the most of employer benefits

With open enrollment coming up, make the most of employer benefits to create your life plan: healthcare, disability, retirement.

Opportunity is missed by people because it is dressed in overalls and looks like work.

(Thomas Edison)

With open enrollment coming up, it’s important to review and reflect on the value of the (typical) employer benefits so as to make the most of them to create your life plan. Employer benefits make up an average 32% of total compensation.[1] The bigger your company is, the seemingly greater the perks. For the sake of simplicity, I categorize employer benefits into two key buckets:

· Financial: Healthcare, disability (and life) insurance, retirement plan

· Lifestyle: Flexible work schedule or locale (home or office), paid time off (PTO), maternity leave, commuting stipend

In this post/article, I will focus on what I consider the most important financial benefits and will suggest ways for optimizing them for different (life) situations.

Health Insurance

When evaluating healthcare plans, it’s best to ask yourself: Is this a benefit I want to or am likely to consume now or later? If the answer is now, then best to review and select the group healthcare plan that’s best for you: PPO, HMO, POS. If you’re like many people, selection is heavily weighted towards providers’ service/expertise, copay and convenience.

However, for those who are young-ish (20-50), healthy, have a family history of longevity and, thus, are more likely to consume healthcare benefits in retirement (or later), then consider an HSA, if your employer offers it. According to Fidelity, here’s how much an average couple retiring in 2019 will spend in healthcare/medical cost – $285,000; a single woman – $150,000; a single man – $130,000.[2] Additionally, it’s estimated that healthcare costs will increase an annual average of 5%, twice the inflation rate.

Given the trends in longevity and healthcare cost, for healthy, young(er) workers, an HSA may be the best fit as it allows you to build up healthcare savings for when you need it most – retirement. In my opinion, an HSA is the ultimate retirement plan as it offers triple tax benefits:

· Contributions are tax deductible.

· Assets grow tax-deferred.

· Withdrawals for qualified medical expenses are tax-free. (NOTE: The definition of qualified medical expenses is quite broad: over-the-counter medicine, surgery, assisted living, etc.)

There are the drawbacks to an HSA:

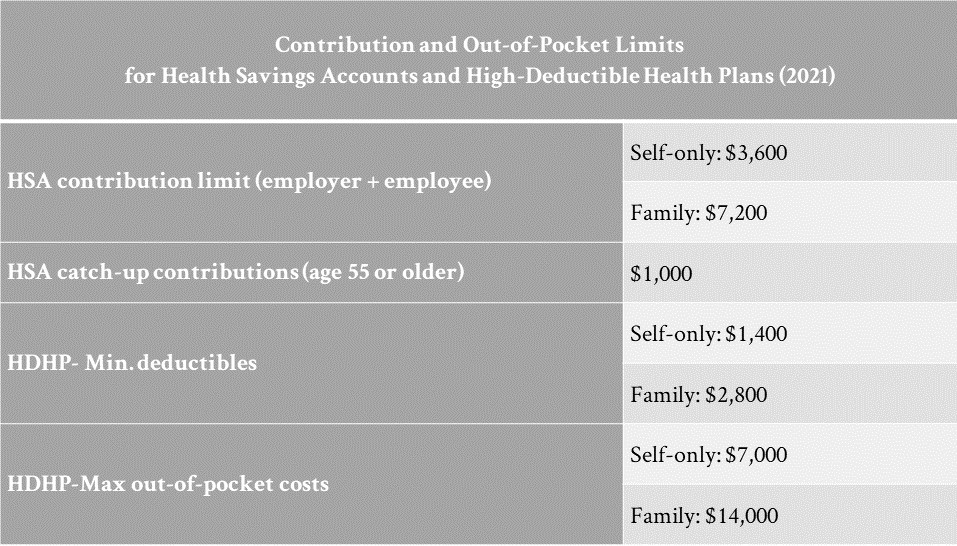

· You must be a on a high-deductible insurance plan.

· Contribution limits are relatively low.

· HSA custodians have a tendency to nickel and dime investors. (Here’s Morningstar ranking of the best HSA custodians: here.)

Disability Insurance

If you’re young, one of your greatest assets is your earnings potential. Interestingly, a 20-year-old worker has a 25% chance of becoming disabled and only a 13% chance of death between now and retirement.[3] Moreover, women file more claims than men.

Top short-term disability claims:

1. Pregnancies

2. Musculoskeletal disorders affecting back, spine, knees, hips, shoulders, etc.

3. Digestive disorders (e.g., hernias, gastritis)

Top long-term disability claims:

1. Musculoskeletal disorders

2. Cancer

3. Pregnancy

As with any major “purchase,” you need to weigh the rewards against the risks and find your sweet spot in terms of coverage and premium. Here are the key variables to consider when evaluating disability insurance:

Short- or long-term: Short-term disability covers you up to 2 years, while long-term disability up to as long as age 65. Best to go with long-term disability, preferably until retirement (age 65) or when you think you will have built up enough savings to support you for life. Meanwhile, consider establishing an emergency fund that can cover 6-12 months’ worth of living expenses to double as short-term disability insurance.

Definition of disabled: Benefits eligibility is heavily dependent upon which definition of disability you choose: own-occupation or any-occupation. Own-occupation allows you to claim benefits when you can’t do your latest job any more while any-occupation means you can claim benefits when you can’t do any job any more. Given the lower “proof bar” for own-occupation, it’s more valuable and, thus, more expensive. Still, best to go with an own-occupation policy.

Elimination period: This is the period you’d have to wait between when you become disabled and when you can begin collecting benefits. The average is 90 days for long-term disability insurance. However, the longer you’re willing to wait for benefits, the lower your premium.

Monthly benefits: A good target is 50-60% of base income. For most people, this can cover a good portion of necessary living expenses.

Taxes: If your employer pays the premium, your benefits will be taxed as ordinary income. If you pay all the premium, your benefits will be tax-free.

(NOTE: If you have dependent kids and a sizeable mortgage, you should seriously consider buying additional term life insurance beyond the typical employer coverage: benefits = 2 times your annual salary.)

Retirement Plan (401k, Roth 401k, After-tax 401k)

A healthy retirement savings can cover a multitude of financial

sins. Below are the different tax flavors of the 401k…and their

potential companion – Roth IRA.

|

Retirement Accounts |

Tax advantages/treatments |

Annual Limit |

|

401k |

· Contributions are tax-deductible. · Assets grow tax-deferred. · Withdrawals are taxed at ordinary income tax. |

$19,500* |

|

Roth 401k |

· Contributions are not tax-deductible. · Assets grow tax-deferred. · Withdrawals are tax-free. |

$19,500* |

|

After-tax 401k |

· Contributions are not tax-deductible. · Assets grow tax-deferred. Withdrawals are taxed at ordinary income tax. |

$37,500** |

|

|

|

|

|

Roth IRA*** |

· Contributions are not tax-deductible. · Assets grow tax-deferred. · Withdrawals are tax-free. |

$6,000 |

*Annual combined contribution to a 401k and Roth 401k cannot exceed $19,500.

**Annual combined contribution to retirement plan (e.g, 401k, Roth 401k, after-tax 401k) cannot exceed $57,000.

***A Roth IRA is an individual retirement account and must be established on your own at a preferred financial institution (e.g., Vanguard, Fidelity).

Confused over what this all means? Not sure which retirement accounts is best for your situation? Here’s my general rule-of-thumb:

If your income is less than $100,000 per year:

1. Max out your 401k.

2. Max out your Roth IRA (via Vanguard, Fidelity, etc) if you have leftover savings.

If your modified adjusted gross income (MAGI) is more than $139,000 (single) and $206,000 (couples):

1. Max out your 401k.

2. Max out your Roth IRA via back-door Roth.

If your modified adjusted gross income (MAGI) is WAY MORE than $139,000 (single) and $206,000 (couples):

1. Max out your 401k.

2. Max out your Roth IRA via back-door Roth.

3. Contribute more to your after-tax 401k or brokerage account (via Vanguard, Fidelity, etc).

By saving in a combination of tax-deductible, tax-deferred and tax-free accounts, you’re able to reduce your income taxes now and gain more flexibility in reducing your overall taxes later (in retirement).

Conclusion

According to the paradox of choice, more isn’t necessarily merrier. When it comes to employer benefits, more options can leave employees more prone to dissatisfaction, making inappropriate choices and/or making no choices at all (paralysis). In my opinion, when it comes to selecting employer benefits, the critical components are health insurance, disability insurance, retirement savings accounts…and life insurance if you have dependents and a sizeable mortgage. Done strategically, these benefits go a long way in helping to secure your (financial) life now and later. Get a few of the big stuff right and you can afford to get a lot of the small stuff wrong!

[1] “Benefits as a Percentage of Wages,” Small Business Chronicle, August 2020.

[2] “Here’s the Shocking Amount a Couple Retiring Today Will Spend on Health Care,” Money, April 2019.

[3] “DISABILITY AND DEATH PROBABILITY TABLES FOR INSURED WORKERS BORN IN 2000,” Social Security Administration, June 2020.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.