Investing-What's the best way to put money into the market?

Given the ongoing debate between lump sum investing versus dollar cost averaging, it’s important to realize that the determining factor for investment success is you, the investor.

The man who moves a mountain begins by carrying away small stones.

(Confucius)

When it comes to investing, the key decisions are centered around answering these questions:

· What: Asset allocation (stocks, bonds, REITs, cash)

· Where: Which account types – tax-deferred, taxable, tax-free

· How: Lump sum or dollar cost averaging

· When: Cadence – weekly, biweekly, monthly

Today, I’d like to cover “how.” Since there are countless articles written on lump sum investing vs dollar cost averaging, for some time now, I’ve held off on giving my perspective for fear of adding to the noise. However, investing is the cornerstone of most (fortunate) Americans’ retirement plan. Moreover, it’s not uncommon that clients ask me why I’ve recommended one mode of investing over another. As is, I thought it was important to share my two cents on this topic to further tease out the nuances around these seemingly black and white options and potentially help investors make a more informed decision.

What’s the difference between lump sum investing and dollar cost averaging?

Lump sum investing is when you put a lump sum of money (e.g., ten thousand, fifty thousand, one hundred thousand) into the market all at once. Meanwhile, dollar cost averaging involves dividing up the lump sum into equal portions and investing these smaller sums into the market over a certain period of time. Here’s an illustration of how these two methods of investing work numerically:

· Lump sum: Invest a total $120,000 into the market immediately

· Dollar cost averaging: Invest $10,000 into the market at the beginning of each month for 12 months.

The former puts your investment to work immediately as you receive dividends and potentially capital appreciation sooner versus later while the latter puts your investment to work more slowly over time.

Which investing method is better?

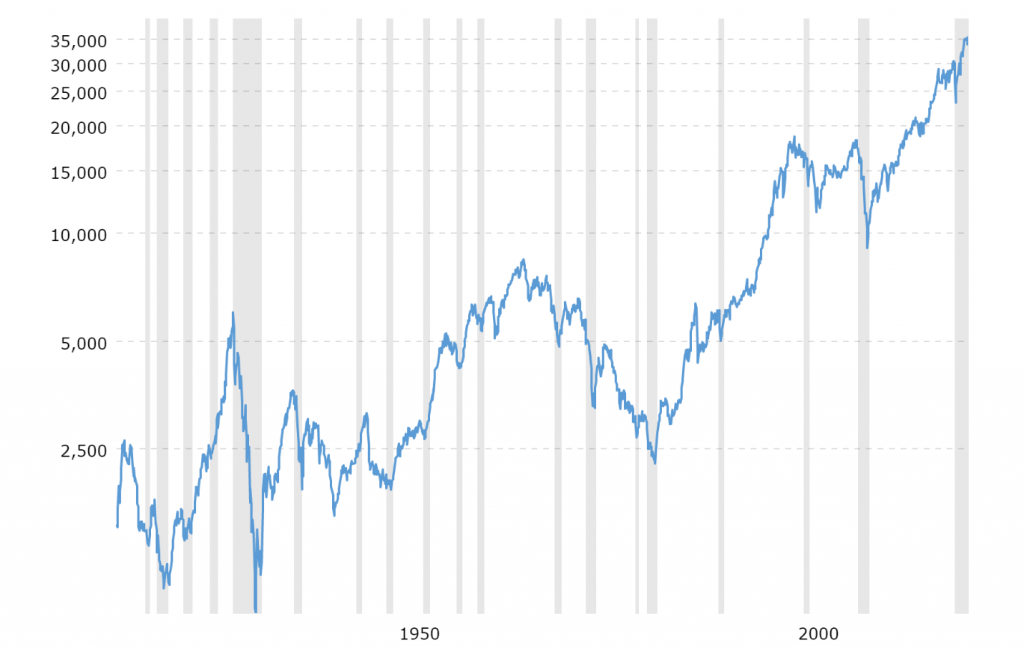

According to a Vanguard study comparing lump sum versus dollar cost averaging, the former resulted in higher overall return 66% of the time.[1] Reason being, the sooner you put your money to work, the sooner you benefit via dividends and potentially price appreciation. Additionally, in terms of historical trends, the stock market typically goes up over time. (See Exhibit 1.)

Exhibit 1: Dow Jones – DJIA – 100 Year Historical Chart (2021)

Source: Dow Jones – DJIA – 100 Year Historical Chart, October 2021.

Unfortunately, as with most things in life, things are not as simple as they seem. Successful investing requires finding a delicate balance between opposites, foremost being:

· Profitability: Risk vs return

· Psychology: Risk tolerant vs risk averse

· Timing: Now vs later vs much later

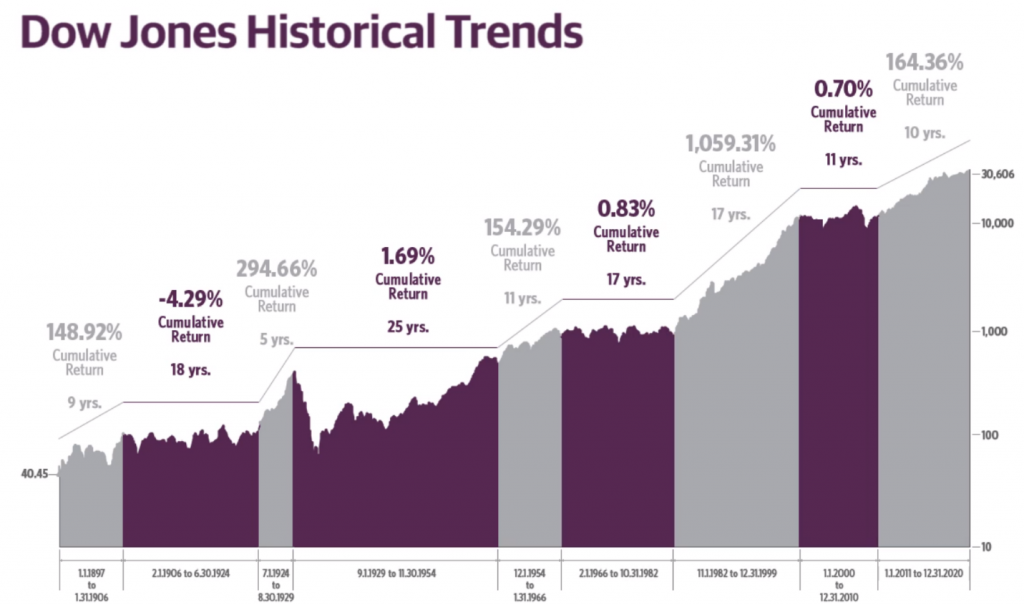

In terms of profitability over the long-term (10 years-plus investment horizon), lump sum is the better option. However, there are a few caveats to keep in mind. First, while the market trends up over time, an equally prevalent trend is that bull markets are always followed by bear markets, some of which last more than a decade. For example, it took the market 25 years to recoup losses from the Great Depression. (See Exhibit 2.) Second, not everyone has a 100-year investment horizon. The average American worker has a 42-year career (at most) wherein they can earn, save and invest.[2]

Exhibit 2: Dow’s Bull and Bear Markets (1897 – 2020)

Source: Guggenheim Investments using data from dowjones.com. (2020)

In terms of psychology, different investors have different risk tolerance level. Moreover, it’s typically very difficult to gauge individuals’ risk tolerance level with a high degree of accuracy. Unfortunately, most people’s real risk tolerance level is revealed during a market crash. And, if they’ve just invested a lump sum beforehand, it may be harder to hold when faced with a sharply declining portfolio.

While lump sum investing is an offensive strategy that seeks to take advantage of the market’s predominantly upward trend over (a long) time, dollar cost averaging is a defensive (investing) strategy where one assumes that it’s impossible to predict the market’s direction in the short- and mid-term. As is, it’s (psychologically) safer to invest in smaller increments over a certain period of time. This way, you’re able to buy some shares high, some low, some in the middle.

Conclusion

When it comes to investing, the best strategy is to buy and hold and hold and hold… It’s in the holding that investors make their money as that facilitates compounding – “the eighth wonder of the world” (Albert Einstein). To be able to hold investments successfully over a long period of time is a balancing act that requires taking into account a host of competing factors: profitability; psychology; time. While lump sum investing may be statistical more profitable over time, dollar cost averaging may be psychological safer over time and, thus, may help you hold onto an investment longer, resulting (potentially) in greater profitability.

Ultimately, when it comes to successful investing, the real deciding factor is you, the investor. Although it’s important to be aware of the pros and cons of different approaches, it’s probably more important to know yourself. So, rather than ask yourself if lump sum investing or dollar cost averaging is better, ask yourself which method will allow you to hold your investments the longest over time. Truth is, at the end of the day, it’s not the buying (and selling) that’s most difficult, but rather the holding.

[1] “Dollar cost averaging just means taking risk later,” Vanguard, 2011.

[2] “How Many Years Do You Have to Work Before You Retire?” Forbes, May 2021.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.