How much is enough?

Given the marked shift from pensions to 401k retirement plans, workers long to know how much is enough for a secure retirement.

Shift in retirement plans

Since the introduction of the 401k in 1978, there has been a marked shift in terms of employees’ retirement savings from pensions to 401k or 403b, its non-profit equivalent. In 1978, approximately 30 percent of private sector employees had a pension plan. As of 2017, that number has dwindled to less than 5 percent.[1] This has dramatically altered how Americans think, plan and save for retirement. Unlike previous generations who could rely on employer pension and Social Security for a secure retirement, more and more of today’s workers must rely more heavily on their company’s 401k or 403b to fund their retirement. The retirement risks have been transferred from employers to employees. It’s no wonder then that many workers are overwhelmed about successfully saving enough for retirement. Underlining their effort is the pervasive question: How much is enough?

How much is enough?

It depends. Enough is a two-sided coin: your spending and your saving. The general rule-of-thumb is to save 25-30 times your annual expenses. (NOTE: I’m excluding Social Security from this calculation.)

If your annual expense is $40,000, then you should target saving $1,000,000 ($40,000 x 25).

If your annual expense is $25,000, then you should target saving $625,000 ($25,000 x 25).

If your annual expense is $10,000, then you should target saving $250,000 ($10,000 x 25).

Your spending determines your retirement savings and vice versa.

Now, you might wonder: Why 25-30 times annual spending? What about health insurance? What about stock market volatility? How can I be sure that saving 25-30 times my annual expenses will be enough?

The 4 percent rule (aka safe withdrawal rate)

In 1998, three finance professors from Trinity University in Texas published a groundbreaking finding from their study to determine the safe withdrawal rate for various portfolios over a 30 period (1925 to 1995). They concluded that a portfolio with an asset mix of at least 50 percent stocks and 50 percent bonds should be able to accommodate a 4 percent annual withdrawal rate, regardless of market conditions, for 30 years[2]. Additionally, they noted that a 4 percent withdrawal rate was a fairly conservative estimate of how much you can pull out from your portfolio over a 30 year period, if not longer.

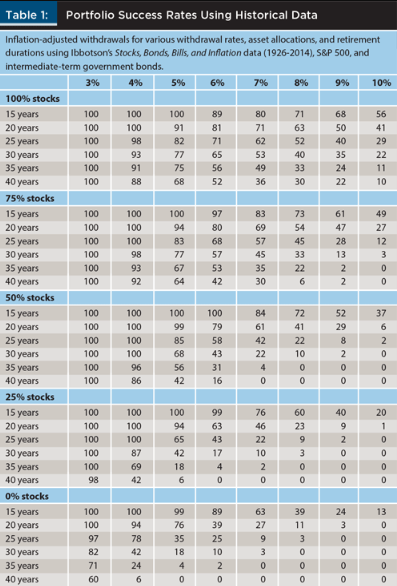

Recent updates to this study support the conclusion that a portfolio of at least 50 percent stocks and 50 percent bonds would support a 4 percent withdrawal rate for at least 40 years. (See Table 1 below, which factors in the Great Recession of 2008-2009.) So, a $625,000 portfolio (50 percent stocks and 50 percent bonds) would enable you to withdraw 4 percent or $25,000 (.04 x $625,000 = $25,000) annually with an 86 percent confidence level that your portfolio will last 40 years. Hence, the rationale that you should target retirement savings at least 25 times your annual expenses. (NOTE: Every individual’s situation is different, so best to consult/confirm with a financial professional concerning your target retirement savings.)

Source: “The Trinity Study and Portfolio Success Rate Updated to 2018,” Forbes, January 2018.

Ways to mitigate risks

The riskiest or most precarious time in retirement is the first 10 years (or sequential risk). If a portfolio is depleted too quickly in the early years (especially in the first 5 years) because of a down market or high spending rate, there will be less assets left over to compound and fund the later years.

To mitigate this risk, those who are about 5 years from retirement should consider creating a bucket strategy for their investments wherein funds earmarked for the first 3 years of retirement are placed in more conservative “investments” (e.g., online bank, money market) while funds earmarked for after 10 years of retirement are placed in more aggressive investments (e.g., stock mutual funds). Assuming a retirement portfolio worth $625,000, here’s one way to “bucketize” investments for the first 10 years of retirement:

· Year 1-3: Online bank and money market ($75,000 or 3 years of living expenses)

· Year 4-10: 60 percent stocks and 40 percent bonds ($75,000 or 3 years of living expenses)

· Year 10-Plus: 70 percent stocks and 30 percent bonds ($475,000 or the remainder)

By staggering your portfolio in this manner, you help increase your ability to ride out bad markets without depleting your overall portfolio to where you would jeopardize your later years.

How much is enough?

While it’s tempting to try and pinpoint a definitive retirement savings amount, the truth is there is some flexibility within the equation. As shown, your target savings is driven by your spending. If you can spend less, then you can afford to save less and vice versa. Additionally, if you are conservative and would like to create a larger margin of safety for your portfolio, then consider saving 30 times your annual expenses.

Still, it’s important to remember that enough isn’t just a number, but rather a state of mind. And, there is no equation that will help you arrive at that “number.” Rather, it’s a delicate, ongoing negotiation between your needs, wants and values.

Find out if you have enough:

Vanguard Retirement Nest egg Calculator

[1] “Tracking the Shift in Private-Sector, Employment-Based Retirement Plan Participation From Defined Benefit to Defined Contribution Plans, 1979–2017,” Employee-Based Retirement Income (EBRI), June 2019.

[2] “The Trinity Study and Portfolio Success Rate Updated to 2018,” Forbes, January 2018.

Recent Posts

- Year-end reflections on gratitude and wealth December 22, 2023

- Power of Patience: Make the most of your 401k December 1, 2023

- Successful Financial Planning: Part Magic, Part Math October 27, 2023

- Long-term Disability (LTD) Insurance: Protect your most valuable asset (YOU) September 15, 2023

- Summer Reading: Three books I recommend June 16, 2023

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.