History lessons on pandemics

and market cycles

History offers some simple, but critical, lessons on pandemics and market cycles and how to protect ourselves in the short-term so that we can thrive in the long-term.

History doesn’t repeat itself, but it often rhymes.

(Mark Twain)

Current (bear) market

Beginning in March, the Dow officially entered bear market territory by declining more than 20 percent. As is, I’ve been getting more questions concerning the market. Understandably, people are anxious and want reassurance that all will be okay. Since this is my third bear market, I feel confident that we will be okay in the long-term. However, I’m less sure about the short-term. My best guess is that we still have more rough waters ahead of us as we’re facing two crises – a medical crisis (coronavirus) and an economic crisis (business shut-down and unemployment). While the stock market seems to have factored in the medical crisis, I don’t think it has fully factored in the economic crisis. We will get a better understanding of the latter when unemployment filings and corporate earnings start rolling out in the coming weeks and months.

Historical context and guide on market cycles

It’s often said that history is a great teacher and guide. At no point is this truer and more necessary than now as we’re in the midst of a global pandemic. To slow the spread of the coronavirus, thus far, one of our most effective prescriptions has been social distancing, a strategy that’s believed to have been used as early as biblical time to curb the spread of leprosy.

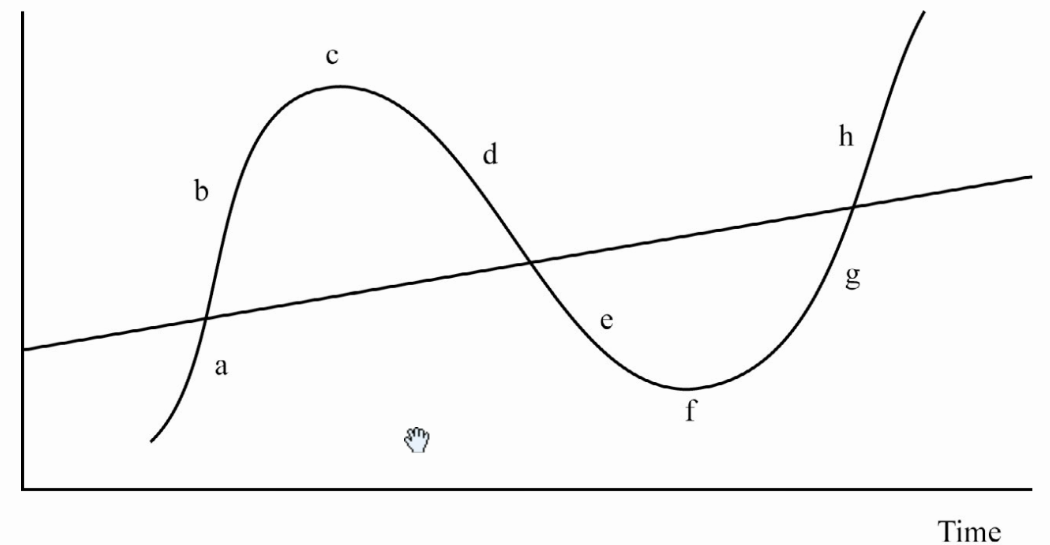

Interestingly, history offers context and possible solutions to our ailing economy as well. Howard Marks, the co-founder and co-chairman of Oaktree Capital Management, is one of the best students of market cycles and modern-day investors. In his latest book Mastering the Market Cycle, he illustrates the typical market cycle (below). Regardless of the crisis trigger, market cycles always follow this trajectory as surely as birth, life and death.

Exhibit 1: Market Cycle

Marks provide a useful explanation for different points in a market cycle.

a) Recovery from an excessively depressed lower extreme or “low” toward the mid-point.

b) The continued swing past the mid-point toward an upper extreme or “high.”

c) The attainment of a high.

d) The downward correction from the high back toward the mid-point or mean.

e) The continuation of the downward movement past the mid-point toward a new low.

f) The reaching of a low.

g) Once again, recovery from the low back toward the mid-point.

h) Then, again, the continuation of the upward swing past the mid-point toward another high.

These are the overarching themes of Mark’s illustration of market cycles:

· Market highs create the conditions for market lows.

· Market lows create the conditions for market highs.

Where are we in the market cycle?

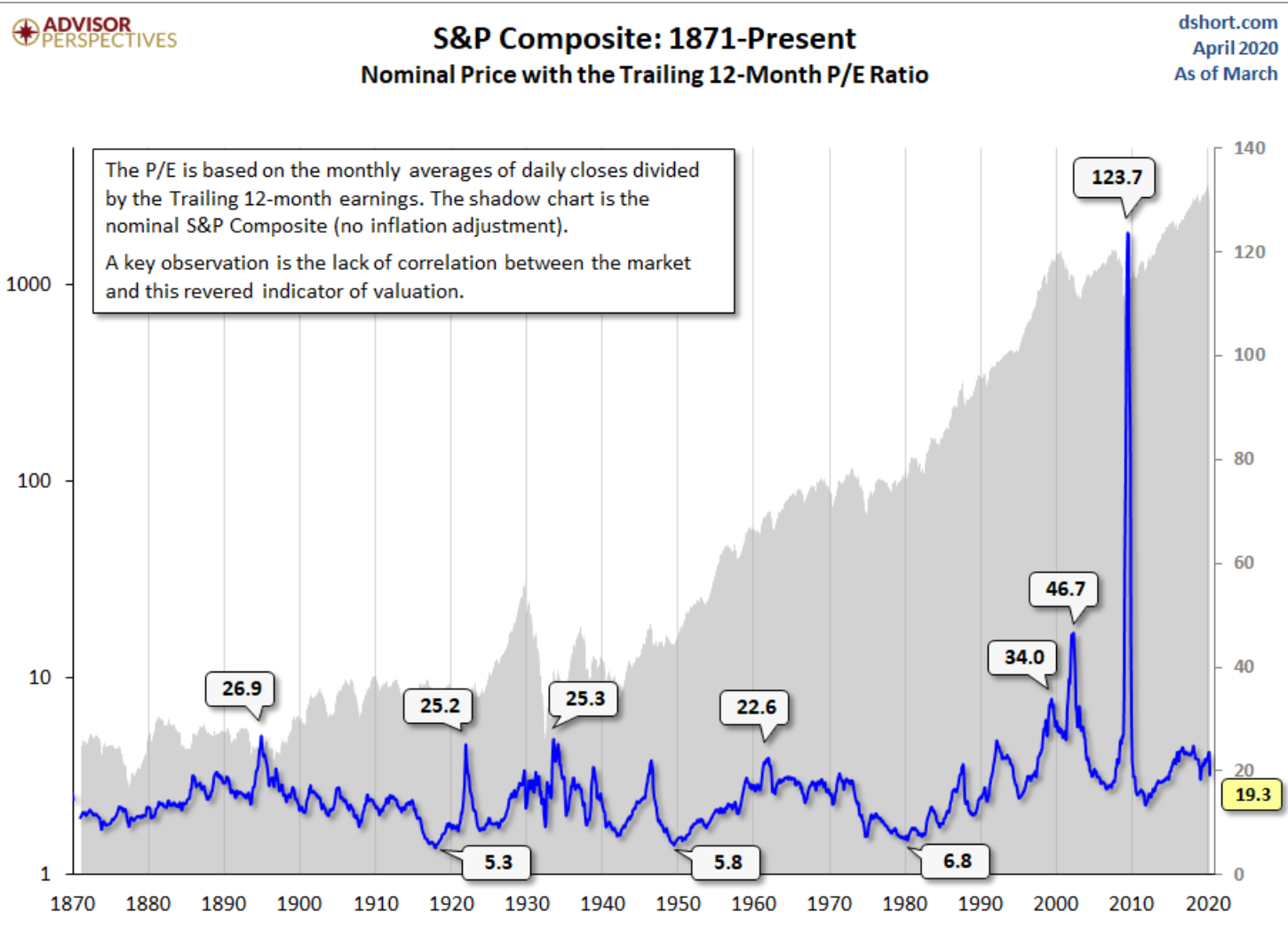

Looking at Mark’s market cycle graph (Exhibit 1), in my opinion, we are somewhere between d and e. Price per earnings (or PE) of the S&P 500 is a standard way to gauge how expensive or cheap the market is. Price per earnings is what an investor is willing to pay for $1 of a company’s future earnings. Historically, the S&P 500 has had an average PE of 16. Earlier this year, PE stood as high as 25. Given the recent drop in the market, however, the current PE stands at around 19. So, while we are above the average PE of 16, we’re below the recent high of 25. (See Exhibit 2 for historical trendline of S&P 500’s PE.)

Exhibit 2: Historical Trendline of S&P 500

How to protect ourselves (financially)

Thus far, this pandemic has taught us some key lessons that would serve us well to remember long after the crisis has passed:

· What we do individually impacts all of us nationally and globally. What takes place nationally and globally impacts all of us individually.

· While we can’t avert every crisis, we each have the power to blunt its impact on ourselves and, thus, others by taking the necessary steps to protect ourselves.

· An ounce of prevention is a pound of cure. (Benjamin Franklin)

By now, we’re all quite versed on how to protect ourselves physically from the coronavirus. How do we protect ourselves financially from the economic fallout? First, have at least 6-12 months of living expenses saved in your bank account. Second, track your living expenses and see where you may be able to cut spending. Third, take this opportunity to exercise (e.g., walking) more. Not only does physical activities help you handle stress better, but they also help strengthen your immunity in the long-term so that you’re more equipped to fight off infections – prevention.

In conclusion…

In the short-term, I have no idea how this pandemic and, therefore, the market will play out. In the long-term, I’m optimistic that we will come out of this stronger. However, what ultimately determines success or failure is what we do in the meantime. As is, we need to continually take steps to safeguard our own physical and financial well-being. Only by surviving the downside will we be around long enough to enjoy the upside.

Stay safe!

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.