Building wealth (Pt 1): Assumptions women hold that undermine their efforts

Based on my experience being a woman and working with women to improve their finances, I notice that many seem to hold a handful of assumptions that undermine their efforts to build wealth.

What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so.

(Mark Twain)

Based on my experience being a woman, socializing with women and working with women on their finances, I’ve often noticed that many seem to hold a handful of (false) assumptions around money that undermine their efforts in building wealth. I want to bring these assumptions to light and address them further.

Money is hard.

Our educational system offers students an extensive curriculum with the goal of setting them up for adulthood and success: math, literature, history, computer programming, art, chemistry, etc. Unfortunately, personal finance isn’t part of the mix. As with math, it seems that many girls become women who (subconsciously) assume that money is hard due to a lack of exposure; negative personal or family experience; stereotypical social and professional reinforcements – money is a man’s world; so on.

Like it or not, all women will face money realities sooner or later which need to be addressed and for which many feel ill-equipped: student loans, car payment, salary and benefits negotiations, retirement plan, inheritance. Overwhelmed, the majority often default to tactics that impede progress: defer, delay, delegate, abdicate.

Still, to move forward, women need to give themselves the critical money education that they were usually never given at home, at school, at work. Here are a few ways to wade into the seemingly murky waters of personal finance:

· Book: The Simple Path to Wealth (JL Collins): JL distills decades of financial learnings and experience into a book that he’d written for his 20-something daughter, who has no interest in finance. He covers everyday financial topics and writes in a style that makes the book easy to read, understand and implement.

· Blogs: Learn how everyday people through self-acquired financial knowledge and discipline achieve financial independence decades before the typical retirement age (62). Here’s a list of top FIRE (Financial Independence Retire Early) bloggers I like to read:

I realize that for many people, money is a pretty dry, if not intimidating, topic. Still, some have shown that it’s not only possible to learn, but also to master. And, now there are increasingly more ways to learn about money. Still, I suspect that for many women their biggest hurdle is not that money is hard, but rather their assumption that money is hard.

A home is a great investment.

Women often assume that a home is a great investment for a number of reasons:

· It’s one of the largest assets they own.

· It’s more concrete than stocks and bonds.

· It has high utility. You can live in it. You can rent it out. You can sell it.

Unfortunately, closer examination reveals that a home is really a big expense, which can turn into a good investment if one manages the expense wisely and with a long holding period (more than 10 years). Here’s a list of the pros and cons of owning a home:

|

Pros |

Cons |

|

· Satisfies need for housing. · Can rent it out. · If paid off, much low(er) housing costs moving forward. |

· High “hurdle” costs: 4.4% o Interest rate (3.3% on 30-yr fixed) o Property tax (1% of property value) o Annual maintenance costs ($3,000) · High transaction costs (6% sales commission) · Illiquid · Limit mobility |

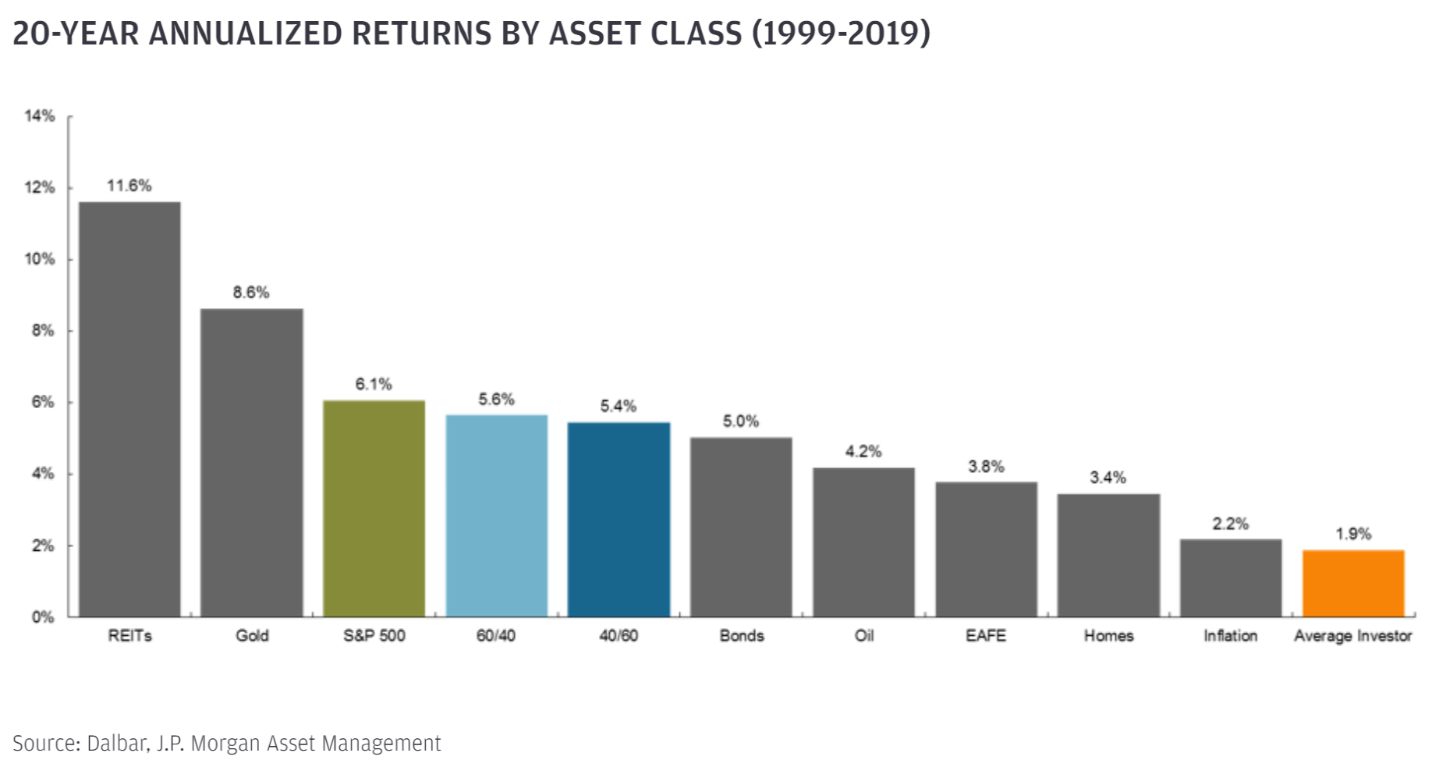

Home ownership typically involves high initial and ongoing costs, which greatly erode overall returns despite appreciation in property values. For some perspective, below is a comparison of different assets’ returns over the past 20 years. Even a conservative investment portfolio (60% stocks and 40% bonds) outperforms a home (5.6% vs 3.4%). For home owners on both coasts, higher home value appreciation rate is often offset by higher home prices.

Personally, I see a home as an emotional investment – a place to live, raise a family, cultivate a garden. Financially, it’s an expense that can become a good investment if you’re able to do the following:

· Buy a home wherein monthly mortgage is less than one-third of net income.

· Be able to stay in your home for more than 10 years; the longer, the better.

· Have enough cash to support ongoing costs (e.g., property tax, maintenance, insurance).

Market timing works.

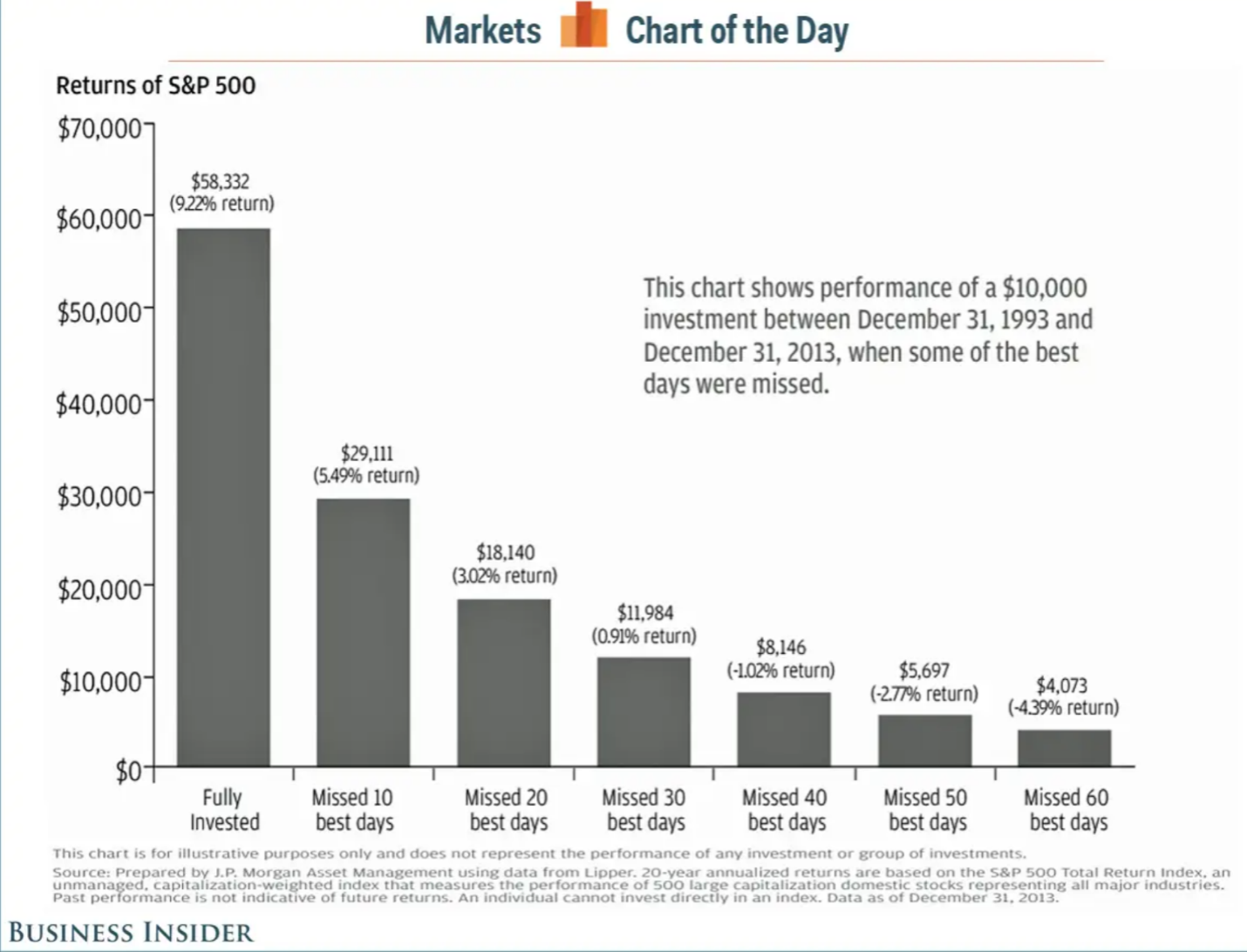

When it comes to investing, the assumption that underlines market timing is that successful investing means avoiding risks, foremost being volatile or declining markets. Thing is, market timing does not work. (See table below.) There are too many known and unknown variables that impact and cause constant gyrations in the market. So, it’s impossible to forecast what the market will do next. Those who time the market are not moved by logic but rather emotions. According to research, due to loss aversion, people feel a $100 loss more keenly than a $100 gain.

As an investor, it’s important to keep in mind that you’re compensated for staying in both an up and down market. When the market is up, you enjoy price appreciation in your investments, which typically accounts for two-thirds of overall returns. When the market is down, you still receive (quarterly) dividends, which usually account for one-third of overall returns.

Moreover, as with home ownership, time helps investments yield great(est) returns as it enables compounding. Let me illustrate the power of compounding with the table below. With a 7% annualized return, the portfolio will double every 10 years. So, over the course of 30 years, a $200K portfolio will become a $1.6M portfolio.

|

Age |

Investment |

|

35 |

$200K* |

|

45 |

$400K |

|

55 |

$800K |

|

65 |

$1.6M |

1) The worker invests in a portfolio composed of 70% stocks and 30% bonds, which has a annualized return of 7%.

2) At age 35, the worker stops putting more money into the portfolio after it reaches a $200K balance.

You’ve probably heard this before, but I’ll say it again: When it comes to investing, it’s not timing the market but rather time in the market that yields the greatest gains.

Conclusion

It’s important to note that the highlighted assumptions are made by both women and men. However, as a female financial planner, I get tremendous visibility into other women’s life, work and especially money. So, I feel like I have a responsibility to share with you some of the key assumptions you hold that are undermining your efforts to build wealth and achieve greater peace of mind.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.