Retirement Savings

(Pt 3): Strategies for solo entrepreneurs

For successful solo entrepreneurs, a solo 401k is a powerful retirement account that allows you to catch up on savings and achieve financial independence sooner versus later.

Self-sufficiency is the greatest of all wealth.

(Epicurus)

Stepping out on your own can be thrilling and terrifying. As with most things in life, there are pros and cons. Pro: It’s all up to you. Con: It’s all up to you. If you’re a solo entrepreneur whose income consistently surpasses her expenses year over year, then congratulations. (No small feat!). Now, if you’re looking for ways to make the most of your savings to build wealth (quickly), then a good place to start is by choosing the right retirement savings account.

Of course, there are the usual suspects Traditional IRA and Roth IRA. Unfortunately, these accounts have an annual contribution limit of $6,000 (or $7,000 if you’re age 50 and over). However, fortunately, there are far better alternatives that offer higher annual contribution limits; flexibility in annual contribution; competitive investment options; easy set up and maintenance; good investment options; low costs. Below is a list of retirement savings account options for solo entrepreneurs.

|

Solo 401(k) |

SEP IRA |

SIMPLE IRA |

|

|

Best for |

• Self-employed individuals, sole proprietors, and business partners and their spouses who are employed by the business. • Those with no employees. |

• Self-employed individuals or W-2 worker with freelance income. |

• Self-employed individuals or any business with 100 or fewer employees. |

|

Advantages |

• Offers highest contribution limits. (You can contribute as an employee and a business owner.) • Contributions are tax-deductible. • Contributions are discretionary; you determine how much or little to contribute annually. • Easy to set up and maintain. |

• Contributions are tax-deductible. • Contributions are discretionary; you determine how much or little to contribute annually. • Easy to set up and maintain.

|

• Contributions are tax-deductible. • Contributions are discretionary; you determine how much or little to contribute annually. • Easy to set up and maintain. |

|

Contributors |

• Employee deferrals and employer contributions |

• Employer contributions |

• Employee deferrals and employer contributions |

|

2021 employee contribution limits |

• Up to 100% of compensation not to exceed $19,500 for 2021. |

• N/A |

• Up to $13,500 in salary for 2021. • Up to $16,500 if age 50 or older for 2021. |

|

2021 employer contribution limits |

• Up to 25% of compensation not to exceed $58,000 for 2021. |

• Up to 25% of compensation not to exceed $58,000 for 2021. |

• Dollar-for-dollar match up to 3% of employee salary. • Contribute 2% of each employee’s salary. |

|

Plan setup deadlines |

• December 31, 2021, for 2021 contribution. |

• Establish by April 15, 2022, or October 15, 2022 (if file extension) for 2021 contribution. |

• Establish by October 1, 2021, for 2021 contribution. |

|

Contribution Deadline |

• April 15, 2022 • October 15, 2022, if file tax extension |

• April 15, 2022 • October 15, 2022, if file tax extension |

• April 15, 2022

|

Benefits of retirement accounts

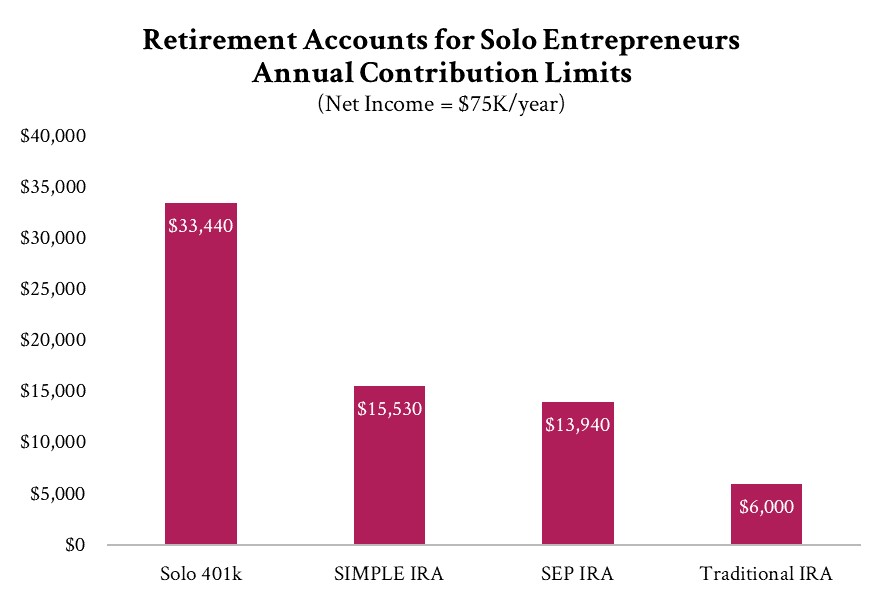

Let’s assume that you’re a solo entrepreneur earning $100,000 per year and your net income (minus business expenses) is $75,000 per year. Here’s a comparison of how much you can contribute to different retirement accounts:

As you can see, a solo 401k offers two times the annual contribution limit versus its nearest competitors. Additionally, the more you contribute to your retirement account, the more you save in income tax. Based on the table below, if you max out your annual contribution to a solo 401k, you’re able to save $6,279 in annual income tax. So, the more you save the more you have to save (or spend).

|

|

Solo 401 |

SIMPLE IRA |

SEP IRA |

Traditional IRA |

|

Retirement Contribution |

$33,440 |

$15,530 |

$13,940 |

$6,000 |

|

Effective Tax Rate – No Contribution |

20% |

20% |

20% |

20% |

|

Effective Tax Rate – Post Contribution |

12% |

15.8% |

16.3% |

18.6% |

|

Tax Savings |

$6,279 |

$3,440 |

$3,090 |

$1,320 |

Moreover, if you have additional savings, consider pairing your solo 401k annual contribution with a Roth IRA. This will enable you to sock away up to $6,000 per year in a tax-free account ($7,000 for those age 50 and over). (NOTE: For those with high Modified Adjusted Gross Income (MAGI) and, thus, do not qualify for a Roth IRA, consider doing a backdoor Roth IRA.) By contributing to your tax-deferred account (solo 401k) and your tax-free account (Roth IRA), you enable yourself to manage income tax more effectively come withdrawal time.

Finally, for solo entrepreneurs looking for more time to generate more income/savings so as to max out the preceding year’s contribution limit, consider filing a tax extension. This way, your contribution deadline is October 15, rather than April 15. (Caveat: Please work with your accountant to confirm your annual contribution limit and when they are due.)

Conclusion

Choosing the right retirement savings account depends on your earnings, savings, goals, investment horizon, etc. However, for most solo entrepreneurs, the solo 401k is probably the best bet. It’s similar to other retirement savings accounts, but on steroids.

As all entrepreneurs know intimately, risk and reward are inextricably intertwined. By choosing to work for yourself, you are taking on enormous risks. However, should you succeed, you also stand to reap great rewards. One such reward is being able to stash far more in retirement accounts than most other workers. In so doing, you’re able to build wealth more quickly and, thus, expedite your journey towards financial independence.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.