How to navigate transitions with more grace and ease

Big life transitions are often scary, because they represent uncertainty and the unknown. While going through transitions, it’s important to focus on your responsibilities, and let Nature take care of the rest.

Life is a process of becoming, a combination of states we have to go through. Where people fail is that they wish to elect a state and remain in it. This is a kind of death. (Anais Nin)

It’s Fall in the Pacific Northwest (PNW). The changing foliage reveals yet another breathtaking dimension to a place already steeped in natural beauty: water, mountains, lush and varied vegetations. I try to walk daily to take in some nature and fresh air.

While out walking the other day, I stopped and stared at the changing foliage on the trees – yellow, orange, red, brown and/or a combination of. (Stunning!) In that moment, I realized the colorful display reflects the great transition from Summer to Fall. This thought brought me back to work wherein a big part of my job is to help prospects and clients navigate (financially) through their own big (life) transitions: new job; new partner; newly single; new home; new money; new role or responsibility; new retirement. As a matter of fact, transitions are often the biggest catalysts prompting women to seek out financial advice. Regardless of the types of transitions we each undergo, it’s not uncommon to approach them with a mixture of excitement, hesitation and/or trepidation. Given my personal and professional experience with transitions, I’d like to share some of my key observations and learnings with you. My hope is they will help you in your respective transitions.

Resistance is dysfunctional and futile

For most of us, big transitions are often scary, because they represent uncertainty and the unknown. (Is the next “destination” better or worse than the current?) Additionally, successfully navigating through transitions often requires a great deal of consciousness, clarity and work. Given all these factors, it’s easy to understand the strong inclination to cling to the status quo. It’s known and, therefore, “safe”…or, at least comfortable.

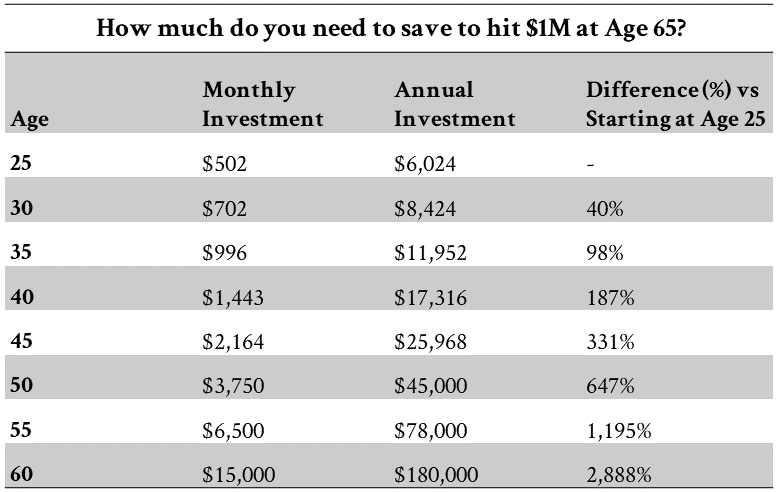

Most of us try to “fight” big transitions a number of ways: ignore, avoid, divert, delay, run away. Unfortunately, such tactics are rarely productive or successful as they go against reality and the natural flow of Life. Avoiding change often leaves us less able to make the most of our opportunities or, worse, grossly unprepared for the inevitable next phase. Moreover, such efforts often become a form of (dysfunctional) work in and of itself. Carl Jung observed: “What you resist persists.” Financially speaking, I’d tweak that quote: “What you resist compounds.” Take retirement savings, for example. By avoiding or delaying saving for retirement, you increase your need to save and invest (exponentially) more to ensure a comfortable retirement. (See table below.)

[

Navigate transitions with more grace and ease

When we are going through our own respective transitions, the experience may often feel singular and personal; more of a trial to be avoided or endured and less of a universal truth to be accepted and managed. Born with thoughts and feelings, it’s understandable that we have strong mental and emotional reactions to change.

As mentioned, transitions are oftentimes scary, because they represent uncertainty and the unknown. To navigate our evitable transitions with more grace and ease, we need only look to trees as examples and guides. First, accept the reality of this moment. Rather than protest or fight the changing of their leaves, trees simply accept it as a part and parcel of their lifecycle. As is, rather than view change with anxiety and apprehension, we should start by simply accepting it. Although seemingly passive, acceptance is often the first and biggest mental/emotional step we can take into our transition.

Second, get clear about what is our responsibility and within our circle of control and then do it the best we can. For trees, this means simply standing rooted in place while big changes take hold from the changing of leaves to the eventual falling of leaves. Continuing with our example of saving for retirement, rather than be side-tracked or consumed by worries or judgement about not saving enough and where this may lead us, it’s usually more productive to get clarity on where we are financially (e.g., monthly/annual income and expense; savings amount; target retirement savings for our age group) and then determine what we need to do next to catch up, if necessary. Rather than extrapolate to an end that is doom and gloom, it’s best to take things step-by-step and do each as best as we can.

Third, realize that transitions are part of a greater process that is cyclical and, ultimately, upward. For trees, Fall and Winter bring about rest, but the coming Spring and Summer bring about renewal as buds magically dot once bare branches and then seemingly and suddenly burst into countless green leaves. Moreover, forest fires clear out natural debris; nourish soil; reduce competition for nutrients; and, ultimately, allow established trees to grow stronger and healthier. In the midst of our transitions, it’s easy to conclude that discomfort and disorientation are perpetual states. However, it’s important to remember that a greater process is at play. Our task is to save for retirement so that Nature can do its magic – compounding! Ultimately, the end goal is not just more money, but also greater flexibility, freedom and peace of mind. Only from this higher plain can we truly live our best Lives.

Final thoughts…

Big transitions are scary, because they often represent uncertainty and the unknown. While navigating through change, it’s more productive to focus on the next step rather than the end (goal). By doing our part, we allow Nature to do its part with the final destination being growth.

RECENT POSTS

December 2023

With year end, I want to share with you some of my personal and professional experiences and observations and the insights they’ve given me regarding gratitude and wealth.

December 2023

For many workers, making the most of your 401k is one of the best things you can do to increase your investment returns exponentially.

October 2023

Countering conventional wisdom, my professional experience has taught me that successful financial planning is based on magic and then on math; on you and then on me.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.