Financial stuff I use

Here’s a list of financial products and services that I use to manage my own finances with the goal being simplicity and low-maintenance.

Money is a great servant but bad master.

(Francis Bacon)

Long before I became a financial planner, I was fascinated by personal finance and its power to amplify one’s earnings, savings and investing. Over the years, I’ve read countless finance books, articles and blog posts on how to make the most of ones’ money. Through a lot of trial and error, I now set up my own finances with an eye towards simplicity and low-maintenance. This way, my money is quietly working for me without my having to manage it. For those who are curious or interested, below is a list of financial products and services that I use to manage (or not manage, depending how you look at it) my own finances.

Financial Tracking: Personal Capital

About 3 years ago, I began using Personal Capital to track and gauge my financial health. I don’t think individuals can make financial progress without first getting a clear(er) picture of where they are. This free software quickly and easily aggregates all my financial accounts (e.g., banks, credit cards, mortgage, retirement plans, brokerage account) into an easy-to-read dashboard that tracks and displays my key financial metrics: net worth, cash inflow, cash outflow, investments, asset allocation, debt, emergency fund. Additionally, my information is updated just-in-time. So, if the transaction shows up in my bank account, then the information is be reflected in my Personal Capital dashboard.

Is Personal Capital safe or secure? I understand the hesitation in providing aggregators, such as Personal Capital and Mint, one’s usernames and passwords for key financial accounts. Based on what I’ve read and my own experience, thus far, it appears that using Personal Capital is as safe, if not safer, than logging into one’s bank account. First, Personal Capital encrypts users’ login information. Second, this encrypted information is stored on Envestnet Yodlee, a platform that supports numerous financial institutions and wealth management tools and companies. Thus, one’s login information is stored in a secure data center versus being transmitted via one’s browser. Third, Personal Capital doesn’t allow users to make financial transactions on its dashboard. Rather, financial information are merely aggregated and displayed. Finally, Personal Capital uses two factor authentication for user login.

Investments: Vanguard

Personally, I’ve been using Vanguard for about 22 years now. It’s my favorite mutual fund family. Here are two big reasons why I love Vanguard: 1) great (index) fund performance 2) low costs. In terms of performance, 87% of Vanguard mutual funds and ETFs outperform their peer group over a 10 year period, ending December 31, 2019.[1] In terms of cost, Vanguard’s average expense ratio is 0.11% versus the industry average of 0.62%.[2] Vanguard is able to hold down costs, because their mutual fund investors are also the company’s shareholders. Their goals are aligned.

Additionally, here are the key funds that I use to create my own portfolio:

· Total Stock Market Index (VTSAX): US blend

· Small-Cap Index Fund (VSMAX): US small-cap blend

· Total International Stock Market Index (VTIAX): International blend

· Total Bond Market Index (VBTLX): US intermediate bonds

Healthcare: The HSA Authority

Over the past 12 years, I’ve been using a high deductible healthcare plan that comes with a Health Savings Account (HSA). In my opinion, an HSA is the ULTIMATE retirement account. If a Traditional IRA and Roth IRA mated, its offspring would be an HSA. It has the best (tax) benefits of both “parents”: a) Contributions ($3,550 for individual and $7,100 for family in 2020) are tax deductible b) Assets grow tax-deferred c) Withdrawals are tax-free. (NOTE: Before age 65, HSA withdrawals for qualified healthcare expenses are tax free. After age 65, HSA withdrawals for qualified and non-qualified healthcare expenses are tax free.)

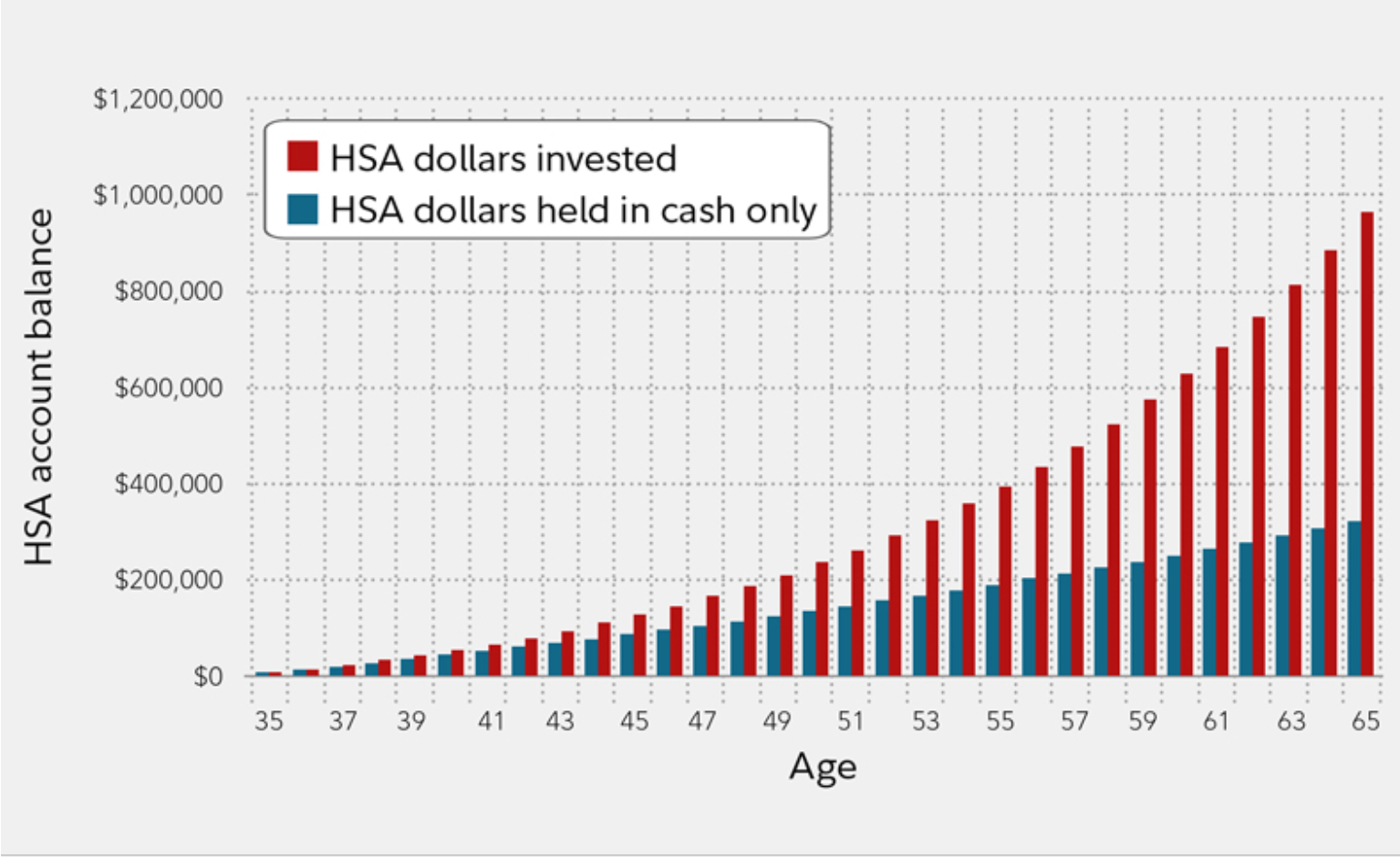

Should you leverage an HSA as a checking account or an investment account? The former allows you to spend money now, while the latter allows you to spend more money later. As with most things, the answer depends on the individual’s situation. However, for those who are age 50 and younger, healthy and can pay out-of-pocket for medical costs, it may be best to invest HSA contributions. Healthcare costs have increased an annual average of 5% over the past 30 years.[3] This is more than twice the average annual inflation rate (2%) over the same period.[4] According to Fidelity, in 2019, a retired couple age 65 will need $285,000 saved at retirement to cover their medical expenses in retirement.[5] As is, investments in a tax-free vehicle with no Required Minimum Distribution (RMD) can compound for decades and, thus, grow into a sizeable sum by retirement when it’s most needed.

Exhibit 1: Hypothetical HSA Balance – Investment vs Cash

Source: “5 ways HSAs can fortify your retirement,” Fidelity, December 2019. Assumptions: 30-year investment time frame; 7% return on investment; 0% return

Source: “5 ways HSAs can fortify your retirement,” Fidelity, December 2019. Assumptions: 30-year investment time frame; 7% return on investment; 0% return

on cash; no withdrawals. The household contributes up to the HSA family limit each year at the beginning of the year. Contributions are indexed to inflation and compounded annually.

Here are the key drawbacks to an HSA: a) Contribution maximum is fairly low b) Many financial custodians that offer an HSA has a tendency to nickel and dime investors. Fortunately, Morningstar publishes annual rating of different HSA custodians for those who want to leverage an HSA as an investment account: here.

Banking

· Personal Savings Account: Ally Bank

I use Ally Bank as my personal savings account. Currently, it pays 1.5% interest, regardless of account balance; deposit is FDIC insured; free transactions (6 per month); quick transactions – moving money between Ally and other bank accounts typically takes 1-2 business days; easy to navigate user interface. While there are other online banks that pay slightly higher interest rates, I chose Ally because I think it’s quite competitive when evaluated against other banks across these criteria:

1. Financial reputation

2. Financial strength

3. Ease of use

4. No (or limited) fees

When choosing a bank or any financial institution for that matter, I try to take a holistic approach.

· Business Savings Account: First Internet Bank

I use First Internet Bank money market savings account as my business savings account. It currently pays 1.5% in interest for minimum balance of $4,000. I don’t mind the higher minimum balance requirement as I prefer to have an emergency fund for my business as well.

When it comes to savings account, I prefer online banks. By limiting overhead costs (e.g., rent), online banks typically pay higher interest rates than brick and mortar banks.

Credit cards

· Personal Credit Card: Chase Unlimited Freedom

As with banking, my choice of credit card is made with an eye towards simplicity and competitive “returns.” With Chase Unlimited Freedom, I get 1.5% cash back on ALL purchases. As is, I try to pay as many of my expenses as possible with my credit card, because I get cash back on stuff that I need anyway (e.g., groceries, utilities). Additionally, by making most purchases with my credit card, I get greater visibility into my spending.

· Business Credit Card: Chase Ink

I use Chase Ink as my business credit card. Its benefits mirror those of my personal credit card.

NOTE: I pay off my credit card bills in full every month. Credit debt is poison!

Considerations

When evaluating financial products and services, I try to do my homework both online and in-person by looking or asking for recommendations from individuals whose opinions I respect and trust. Ultimately, when considering a product or service, I value reputation, reliability, security and simplicity above all else. Oftentimes, this means I forego offerings that pay the highest interest rate or whatever their “reward” program may be. Still, slow and steady wins the race.

[1] “Index funds vs. actively managed funds,” Vanguard, 2020.

[2] “Vanguard Mutual Funds: What They Are, Why They’re Popular,” Nerdwallet, February 2020.

[3] “How US spending on healthcare changed over time,” Petersen KFF Healthcare Tracker, December 2019.

[4] “United States: Inflation rate from 1990 to 2019,” Statista, January 2020.

[5] “How to plan for rising health care costs,” Fidelity, April 2019.

RECENT POSTS

March 2025

Although 2024 double-digit stock market return suggests a strong US economy, the recent change in government leadership and policies highlights the underlying risk (uncertainty) that now weighs down the market and tests American exceptionalism.

December 2024

The fifth anniversary of my advisory firm and the holiday season have prompted me to reflect on my Life’s journey so far and, in so doing, unexpectedly arrive at an unconventional perspective on gifting.

October 2024

August steep market decline serves as a useful dress rehearsal for how we might react in a bear market and what we should do now to increase survival.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.