Capitalizing on a bear market caused by a black swan

For those fiscally responsible and patient, the current bear market represents great short-term risk and potentially greater long-term reward.

The intelligent investor is a realist who sells to optimists and buys from pessimists.

(Benjamin Graham)

Investor profile

Since closing at a high of 29,551 on February 12, 2020, the Dow Jones Industrial Average has dropped by as much as 38 percent to 18,340 on March 23, 2020. Given the coronavirus pandemic, volatility will likely remain high in the coming weeks, if not months, as this saga unfolds. For those able to look beyond the terrifying headlines and see the underlying opportunity in this bear market, this post is for you.

· Do you have a high tolerance and capacity for risk? In other words, do you have both the psychological and financial capacity to survive if the Dow drops by a total of 50 or 60 percent from its high of 29,551?

· Do you want to capitalize on this bear market?

· Do you have 6-12 months of living expenses saved in a checking or savings account, money market, and/or short-term CDs?

· Do you have an investment horizon greater than 10 years?

· Do you want to increase or catch up on retirement savings?

· Do you (preferably) have access to good investment options, such as low cost index funds?

Depending on your answers, here are some investment strategies that may help you capitalize on this moment.[1]

Rebalancing

Determine your overall asset allocation (%) for your retirement and investment accounts: stocks, bonds, cash. Given the recent decline in the stock market, your allocation to stocks has likely decreased relative to overall assets. For example:

· Pre-bear market asset allocation: 80% stocks; 15% bonds; 5%cash

· Current asset allocation: 75% stocks; 20% bonds; 5% cash

Consider using some of your bonds and cash to purchase more stocks to bring overall asset allocation back to where it was prior to the drop. For those, more risk tolerant, consider allocating even more money to stocks than prior to decline: 85% stocks; 10% bonds; 5% cash.

If most or all of your investments are in a target date retirement fund, you can increase your stock allocation by increasing your target retirement year. If you currently hold a target date retirement fund 2040, consider transferring a portion or all of your assets from that fund to a target date retirement fund 2045. In so doing, investment-wise, you are pushing out your retirement by 5 year and, thus, increasing your stock allocation while decreasing bond allocation.

Frontloading: Employer-sponsored plans (401k, 403b, 457)

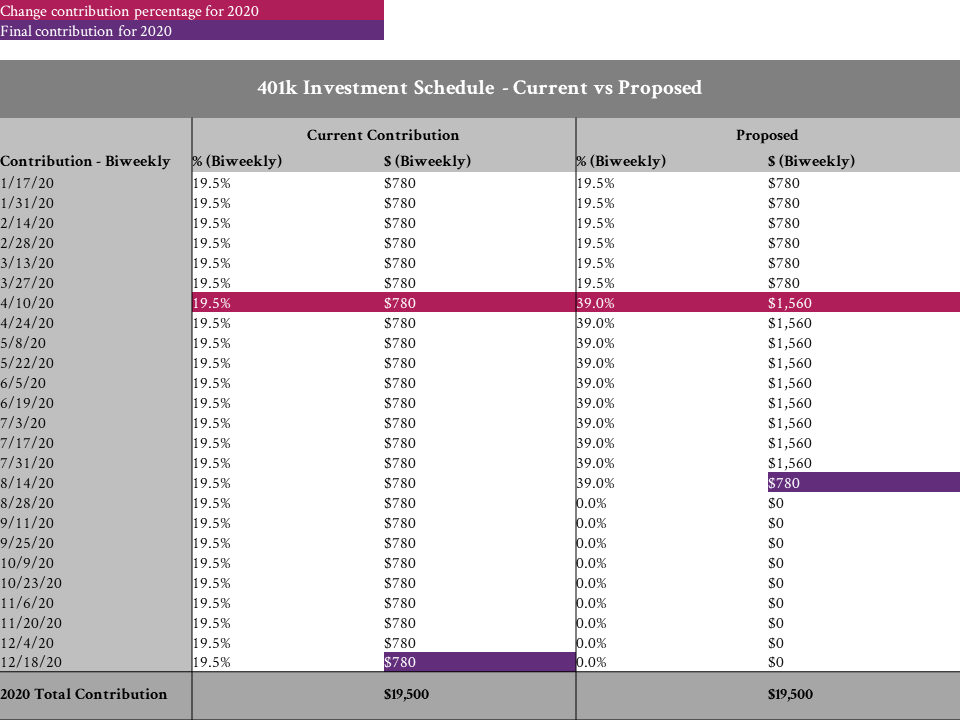

For those of you contributing just enough to your employer-sponsored plan (401k typically) to receive the employer match, consider maxing out your contribution for the year. Moreover, rather than setting your contributions to max out by end-of-December, consider maxing it out sooner perhaps by late summer or early fall. (The table below illustrates how to implement this change.) By frontloading your contributions to the first half of the year, you are able to buy more stocks (now) at lower prices. Also, by pulling your contributions forward, you give your investments more time to compound.

Frontloading: Traditional and Roth IRAs

For those of you (employees) without an employer-sponsored retirement plan and have yet to file your 2019 tax returns, consider funding a Traditional IRA to get an immediate tax deduction as well as buy discounted stocks in a bear market. FYI, if your employer doesn’t offer a retirement plan, your Traditional IRA contributions are tax-deductible regardless of your annual income. Additionally, if you have extra cash that you don’t need for the next 10 years, consider putting some, if not all, of your 2020 contributions into your Traditional IRA now versus later.

For single tax filers with Modified Adjusted Gross Income (MAGI) of less than $124,000 or married tax filers with MAGI less than $196,000, consider contributing $6,000 into your Roth IRA for 2019. If you have a good sense of what your 2020 income will be and if you qualify, consider contributing your 2020 contribution to a Roth IRA now versus later.

Please be aware that you can only invest as much in a Traditional and/or Roth IRA as you’d earned (in income) for the corresponding year. Additionally, your combined contribution to a Traditional and Roth IRA can’t exceed $6,000 or $7,000, if you’re age 50 and older (in 2020).

Leveraging a brokerage account

For those of you who want to invest beyond what’s allowed in your retirement accounts or to circumvent some of the rules and restrictions around those accounts, consider a brokerage account. Contributions to a brokerage account are not tax deductible; assets do not grow tax deferred; withdrawals are not tax-free. However, a brokerage account does offer some advantages that typical retirement accounts do not. First, contributions to a brokerage account are not limited by income and withdrawals are not limited by time (or more specifically your age). With a brokerage account, you can contribute however much you want; you can invest contributions however you want as there are typically more investment options; you can make withdrawals whenever you want. As is, a brokerage account is a great “catch all” investment vehicle for life’s big expenses, including retirement. It’s particularly useful to those to want work to be optional long before the typical retirement age (62).

Second, while a brokerage account doesn’t have the tax benefits of typical retirement accounts, that’s not to say that it doesn’t have any tax advantages. While capital gain distributions are not tax-deferred, you can limit your capital gains tax by purchasing tax-managed funds or index funds wherein turnover rates (buy and sale of holdings) are low(er) than typical active funds. As a result, such funds usually generate less capital gains distributions and, therefore, less capital gains tax.

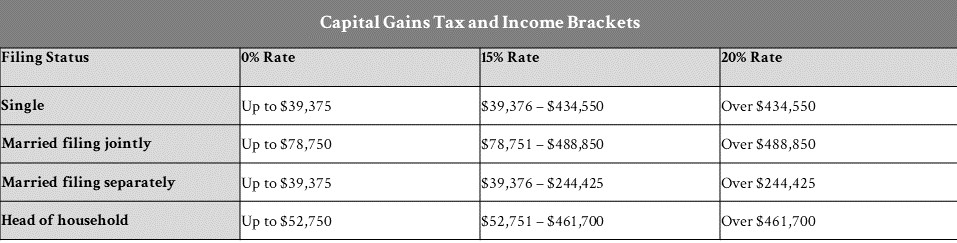

You can limit your taxes further by holding investments for longer than one year and, thereby, reclassifying them from short-term to long-term assets. Sales of long-term investments are taxed at long-term capital gains rate (0%, 15% or 20%), while sales of short-term investments are taxed at ordinary income tax rate. (See table below for capital gains tax with respect to income.) By purchasing tax-managed funds or index funds and holding them longer than a year, you’re able to reduce taxes on your brokerage account investments.

Source: Internal Revenue Service (IRS).

Source: Internal Revenue Service (IRS).

Investing a lump sum

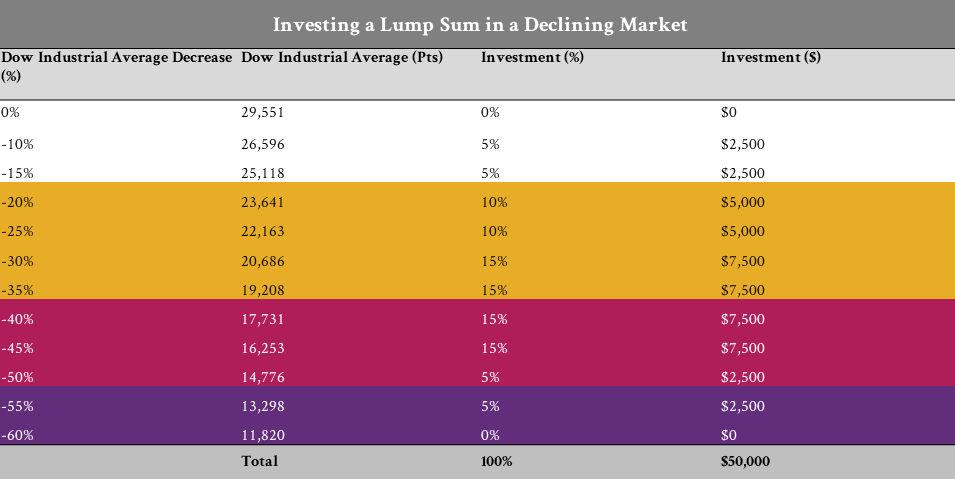

For those with a lump sum sitting in either a retirement or brokerage account, given the volatility in the current market, it’s difficult to know when and how much to invest, because no one knows when and where bottom is. So, it may be helpful to have an strategy that provides a framework and, therefore, the discipline needed to buy in a declining market. One strategy is to invest a little more as the Dow drops by increments of 5 percent. (See table below for an illustration of how this would work for an initial lump sum of $50,000.) While this strategy doesn’t ensure that you’ll buy the most at the bottom, it does help you buy increasingly more on the way to the bottom.

Assumptions: 1) Initial lump sum: $50,000 2) Dow’s high was 29,551 points.

In conclusion…

Investing in a bear market is like digging a hole in your backyard and then burying increasing amounts of money with the belief that it will double over the next 10 years. Doing so requires a great deal of cash, discipline, guts and faith. However, for those who are fiscally responsible and patient, this is the moment you’ve been waiting for.

[1] All individual situations are different. So, it’s always best to consult with a financial professional before making any big financial moves, including investing in a bear market.

RECENT POSTS

March 2025

Although 2024 double-digit stock market return suggests a strong US economy, the recent change in government leadership and policies highlights the underlying risk (uncertainty) that now weighs down the market and tests American exceptionalism.

December 2024

The fifth anniversary of my advisory firm and the holiday season have prompted me to reflect on my Life’s journey so far and, in so doing, unexpectedly arrive at an unconventional perspective on gifting.

October 2024

August steep market decline serves as a useful dress rehearsal for how we might react in a bear market and what we should do now to increase survival.

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2021 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.