You are well-to-do and slightly woo-woo.

Get supportive, smart and

serious financial advice.

About you

As someone who is smart and capable, you are great at doing. So, professionally and financially this likely describes you partially or completely:

· Well-educated, white-collar professional

· Work in tech, healthcare or non-profit / public sector

· High-income (individual: $150K/yr. – $250K/yr.; couple: $250K/yr. – $350K/yr.)

· And/or, high net-worth: millionaire ($1M), if not multimillionaire ($2M+).

· Likely immigrant or child of immigrants

· Have life or legal partner, but typically prefer to retain control and autonomy over own finances.

However, your essence is Being. As is, you want to transform your income and/or wealth into something that matters – financial flexibility or independence – because you long to:

· Do meaningful work.

· Start your own business.

· Care for yourself or others.

· Live closer to family or nature.

· Travel the country or the world.

But, you don’t have the time, interest, energy or frame of mind to figure out where you are financially; where you need to be; what you need to do (next). Still, life happens. You may have just celebrated a milestone birthday; transitioned into a new job or career that offers a lot of opportunities; gotten engaged; received a windfall or life-changing diagnosis…

As a result, there’s a greater sense of urgency in getting your financial house in order so as to secure your future.

You are looking for a financial planner:

· Who listens.

· Who takes into account your past, but sees it as a stepping stone to your future.

· Who wants to understand your financial goals within the greater context of your life and values.

· Who uses math to help you unlock the magic that comes with living your truest Life.

Am I okay? Will I be okay?

Schedule a free consultation and let’s start the conversation.

About me

While our stories may differ in particulars, they are likely similar in theme.

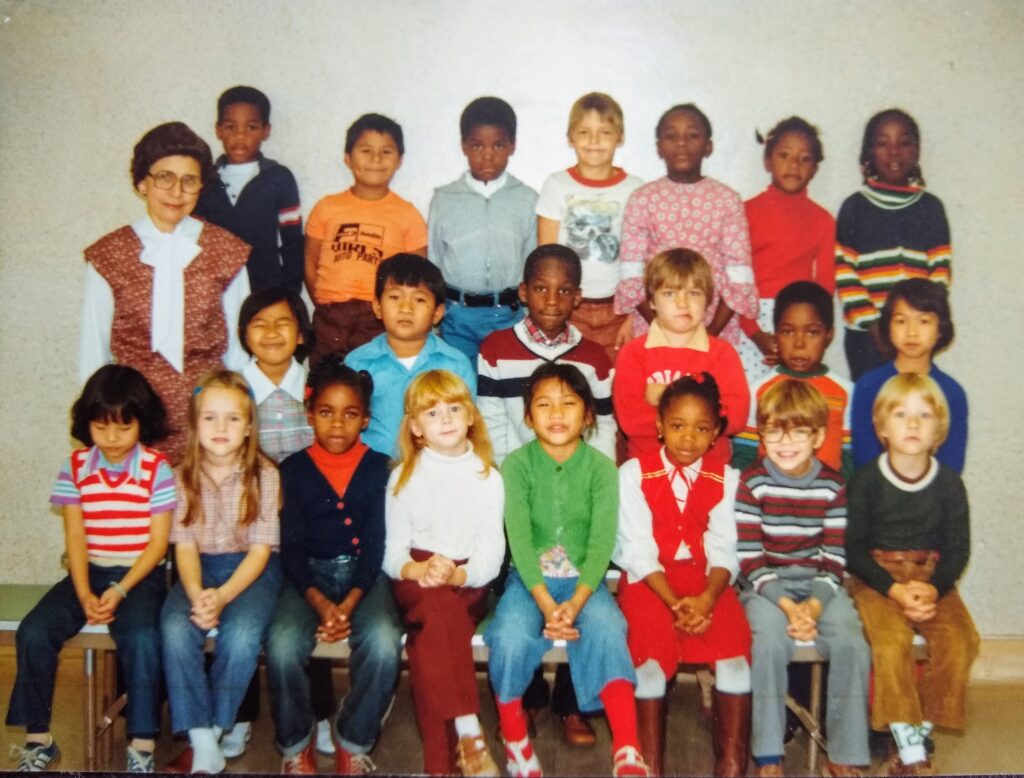

I was born in South Vietnam at the end of the Vietnam War. The years that followed were challenging. My parents lost their business. My father was sent to a Communist “re-education” camp. Late-70s, not long after my father was released, my parents decided to escape Vietnam by walking through minefield-laced Cambodia. They wanted to give my brother and me a better life. After a year of living in various refugee camps through Southeast Asia, my family resettled in Indiana and began the hard task of rebuilding our lives.

(People often ask me why Indiana. Reason being, my parents wanted my brother and me to learn English and assimilate to American society as quickly as possible. Little did they realize that as a young adult I’d have to spend a small fortune to work through my “identity issues.”)

Once in the states, all these events hardwired within me a strong desire to survive through achievements. Growing up, I unconsciously slipped into a pattern of trying to live up to parents’ expectations rather than cultivating and pursuing my own dreams. In my early 20s, this pattern escalated when my mother was left disabled by cancer. Feeling like I’d let my parents down, I increasingly took on more adult responsibilities: help them manage their restaurant; learn to invest their savings; attend grad school; get a good paying job so I can support them in old age. Outwardly, all seemed well. Inwardly, I was growing increasingly angry and resentful from a life deferred.

Fortunately, the Universe is kind and compassionate. But, sometimes grace comes in disguise. At age 35, I finally hit a physical, emotional and mental wall that no amount of hard work could overcome. Having quit my job at a big high-tech company a year earlier, I found myself listlessly sitting across my therapist as she diagnosed me with PTSD. Dumbfounded, I whispered: “Isn’t that a severe mental illness that only affects veterans?” She told me that it impacts people who’ve lived through great personal traumas. My tumultuous childhood had predisposed me to mental illness.

From that day on, I became completely focused on my health and healing. This meant facing, feeling and making peace with the pains, traumas and griefs that I’d live through. As I (re)gained my sense of Self, I began to take step by painstaking step towards the Life that had long called me. This has meant changing industry; changing profession; changing social circles; changing diet; changing city; changing employment status (from employee to owner); and so on.

Surprisingly, I discovered that as long as I found the clarity and courage to take yet another step, Life would support me through ongoing synchronicities and miracles, which also served as sign-posts that I was (finally) heading in the right direction.

It’s been almost 14 years since my therapist delivered that fateful diagnosis. Rather than the end, it marked the beginning of a journey that has realigned my head with my heart; my outside with my inside; my professional goals with my personal goals.

Thus far, this has been my path back towards wholeness and joy. And now, it has brought me to you.

Education, Professional Certification, Interests

Undergraduate: University of Notre Dame (Classics)

Graduate: Purdue University – MBA (Finance and Marketing)

Hobbies: Meditation, walking, gardening, food, art

Books that changed my life: The Road Less Traveled, The Way of Integrity, I Am That

Spirit animal: Turtle

Get a free financial education.

Learn more about key financial topics, such as investing, 401k, disability insurance, paying for a home, at your own convenience. Sign up for Women’s Wealth monthly newsletter and have relevant information delivered to your inbox.

Live life on your own terms.

Do you find yourself constantly stressed or bored at work and wondering when you can live life on your own terms? Learn how to harness money’s energy and begin to create your life rather than manage it.

CONNECT

Anh Thu Tran

Women’s Wealth LLC

P.O. Box 1522

Tacoma, WA 98401

anhthu@womenswealthllc.com

(206) 499-1330

Women’s Wealth LLC is a Washington State registered investment advisor. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.

© 2025 Women’s Wealth LLC. All rights reserved. | Design by Erin Morton Creative, LLC.